How to Request & Modify Employer Account Associations

Third Party Administrators (TPAs) may request access to an employer’s account by initiating an account association inside MyUI Employer+. That request is then sent to the employer for approval. The employer will receive a notification via email and correspondence in their account to review and approve (or deny) the request.

Once approved, the TPA can conduct Unemployment Insurance (UI) activities on the employer’s behalf based on their assigned roles. TPAs may also use this request process to modify existing relationships, account roles and permissions.

Note: Employers are responsible for approving new TPA associations and any modifications to existing associations in their online employer account.

Requesting an Employer Account Association

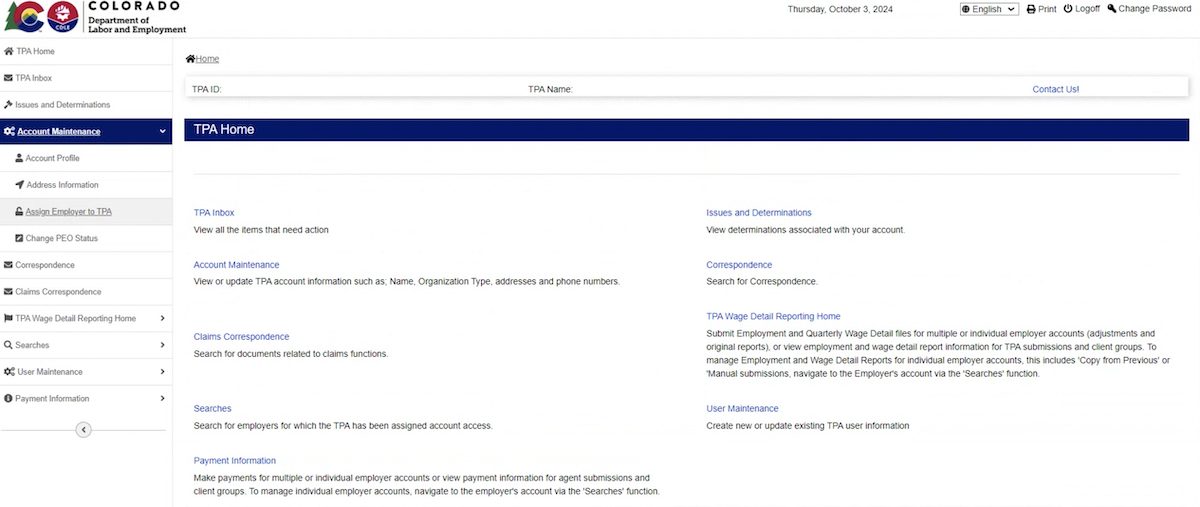

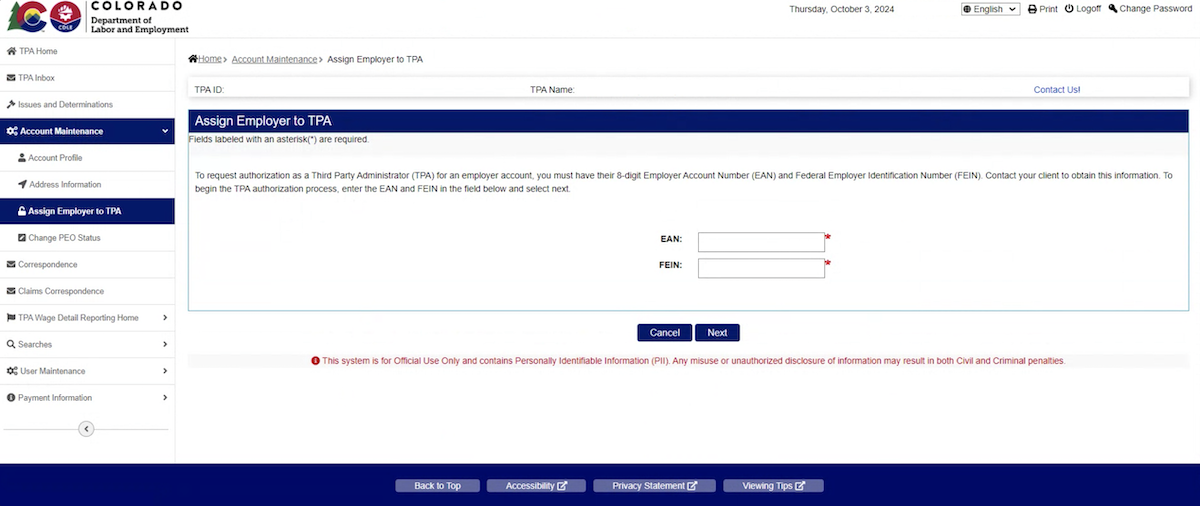

- Login to the TPA account.

- Click “Account Maintenance” in the left-hand menu of the TPA Home page.

- Click the “Assign Employer to TPA” subtab.

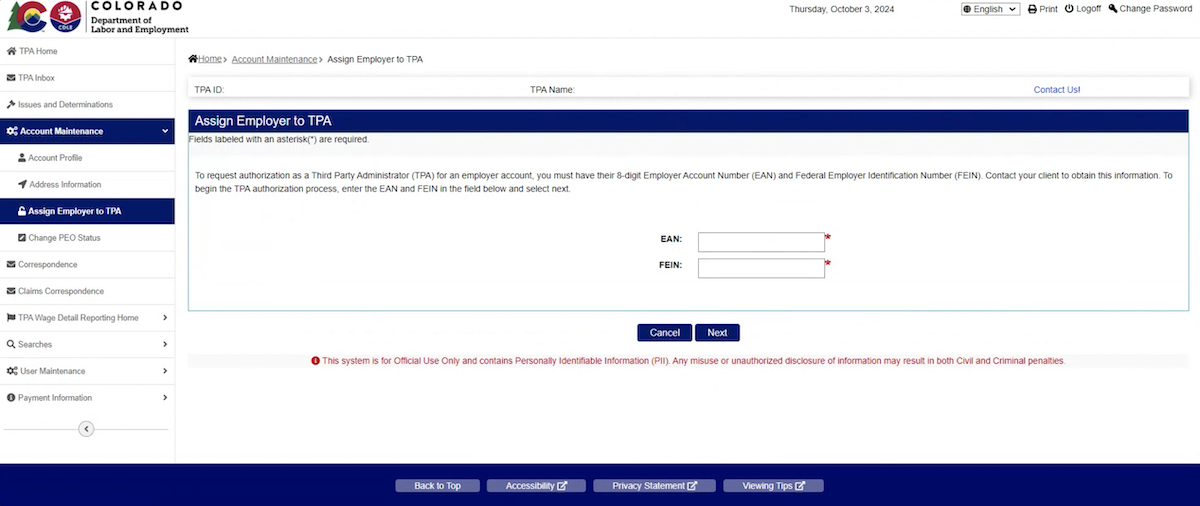

- Enter the employer’s Employer Account Number (EAN) in the required field.

- Enter the employer’s Federal Employer Account Number (FEIN) in the required field.

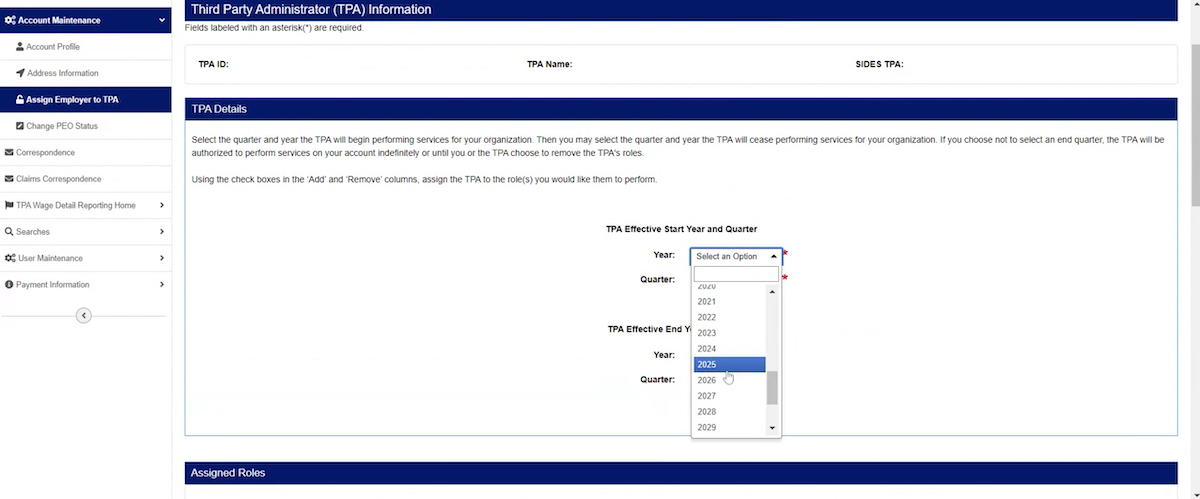

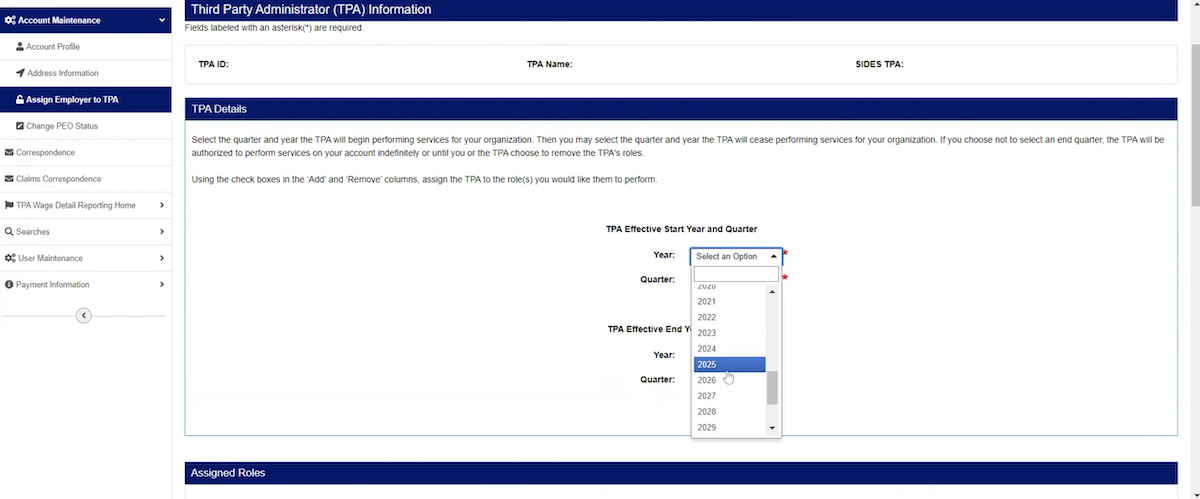

A “TPA Effective Start Year and Quarter” date is required to initiate the association. The TPA Effective Start Year and Quarter must coincide with the beginning of a calendar quarter (January, April, July, October).

TPAs may also select an “Effective End Year and Quarter” when the TPA’s access to the employer account will end. An Effective End Year and Quarter date is not required to initiate the association.

- Select the Effective Start Year and Quarter using the dropdowns in the required field.

- Select the Effective Start Year and Quarter using the dropdowns provided (optional).

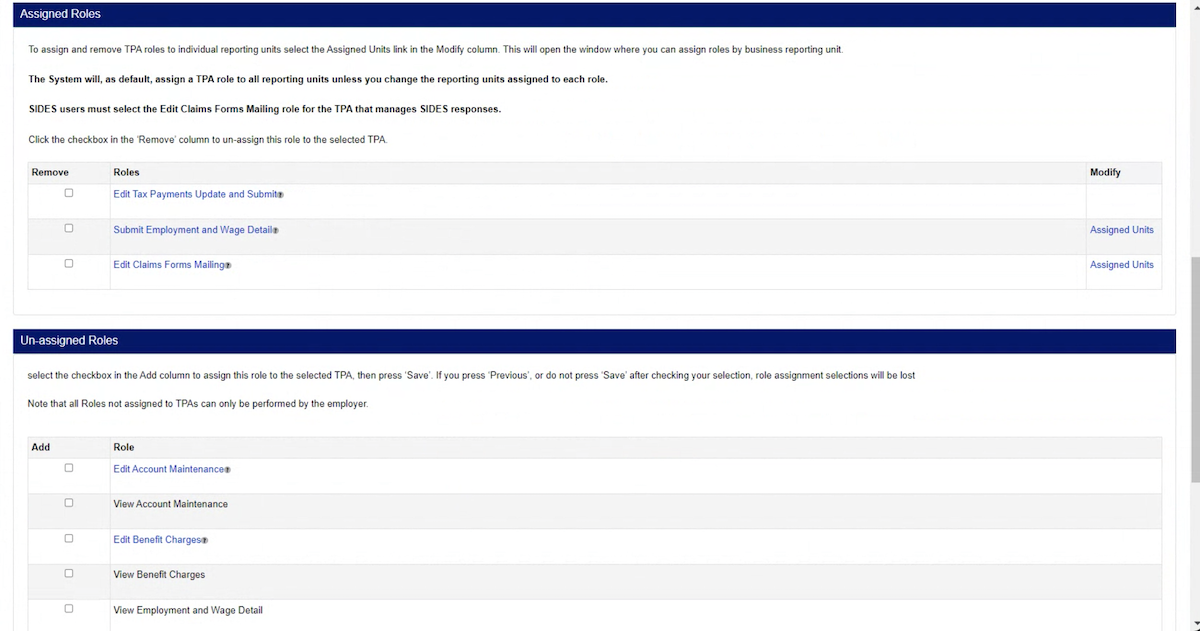

TPAs can include the various roles needed to represent the employer in the association request.

Roles TPAs may be assigned to include:

Edit Account Maintenance:

Ability to edit various Account Maintenance functions on behalf of the employer. These functions include: Employer Address Maintenance, Suspend/Terminate/Reactivate Account, Owner/Officer Information Maintenance, Reporting Units Maintenance, View Employer Account History, Employer Name Maintenance, and Request Liability Date Change.

View Account Maintenance:

Ability to view various Account Maintenance information on behalf of the employer only.

Edit Benefit Charges:

Ability to edit information related to benefit charges. This includes protesting charges assessed against the account, and viewing benefit charges online.

View Benefit Charges:

Ability to view benefit charges for the employer only.

Edit Claims Forms Mailing:

Ability to receive requests for Wage and Separation information and other benefits forms for the employer.

View Claims Forms Mailing:

Ability to view Wage and Separation correspondence that has been sent to the employer only.

Submit Employment and Wage Detail:

Ability to view and submit wage reports, and wage adjustments on behalf of the employer.

View Employment and Wage Detail:

Ability to view submitted wage reports and adjustments only.

View Rate Notice and Voluntary Contribution:

Ability to view the employer’s rate notice and any voluntary contribution.

Edit Tax Payments Update and Submit:

Ability to submit and update premium payments, for both contributory and reimbursable employers, and calculate voluntary contributions.

View Tax Payments Update and Submit:

Ability to view premium payments the employer has submitted only.

Assign All Edit/Submit Roles:

Ability to Edit/Submit all roles. This option will only be available if no TPAs have been assigned an edit/submit role.

Edit Workshare:

Ability to edit the employer’s workshare plan or preferences.

- Select the box next to the roles needed. Once approved, the assigned roles will be applied to the effective start year and quarter selected.

Note: Only one TPA can be assigned to each role in the employer account at one time. - Click “Save”.

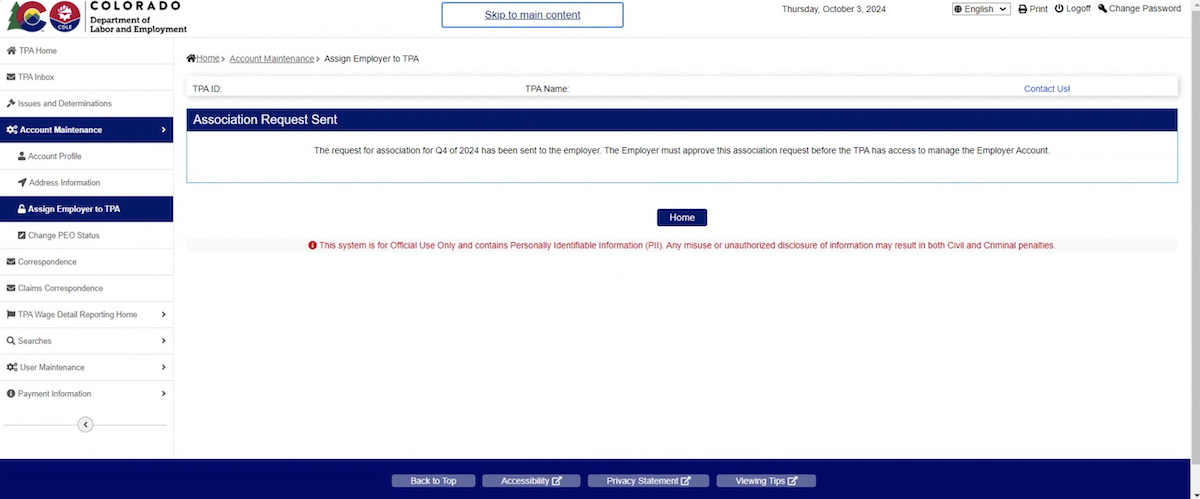

A confirmation screen shows the association request has been sent.

Remember: The employer must approve the association request before the TPA has access to manage the employer account. The employer will receive an email notification and a correspondence in their MyUI Employer+ to review and approve the association request.

Modifying an Existing Employer Account Association

TPAs with an existing employer account association can also request modifications to assigned roles, and effective start and end dates.

- Navigate to the “Assign Employer to TPA” following the steps listed above.

- Enter the related employer’s Employer Account Number (EAN) in the required field.

- Enter the related employer’s Federal Employer Account Number (FEIN) in the required field.

To modify the effective start or end date of the employer association:

- Select the new Effective Start Year and Quarter using the dropdowns in the required field.

- Select the Effective Start Year and Quarter using the dropdowns provided (optional).

To add or remove assigned roles:

- Select the box next to the roles needed to be removed in the “Assigned Roles” section.

- Select the box next to the roles needed to be added in the “Un-Assigned Roles” section.

Note: Only one TPA can be assigned to each role in the employer account at one time.

Once approved, the assigned roles will be applied to the effective start year and quarter selected.

- Click “Save”.

The confirmation screen shows the modification request has been sent.

Remember: The employer must approve modifications to TPA roles in the employer account. The employer will receive an email notification and a correspondence in their MyUI Employer+ to review and approve the request.