940 Certification

Form 940 is an annual return filed by employers to report Federal Unemployment Tax. Form 940 covers the period of January 1 through December 31 and must be filed on or before January 31 following the close of the calendar year.

The 940 Certification is the summary of Colorado taxable wages reported by the employer, and the total amount of Federal Unemployment Tax Act (FUTA) eligible state tax paid into the Colorado UI Fund for a designated year. This information is reported to the IRS and indicates the amounts to be reported on the Federal Form 940 (non-domestic employer).

The FUTA Credit may also be referred to or used in conjunction with the following terms or forms:

- Employer's Annual Federal Unemployment (FUTA) Tax Return

- Employer Account Abstract

- Federal Form 940

- Federal Form 940C

- Proof of Credit

- Re-Certification of UI Taxes

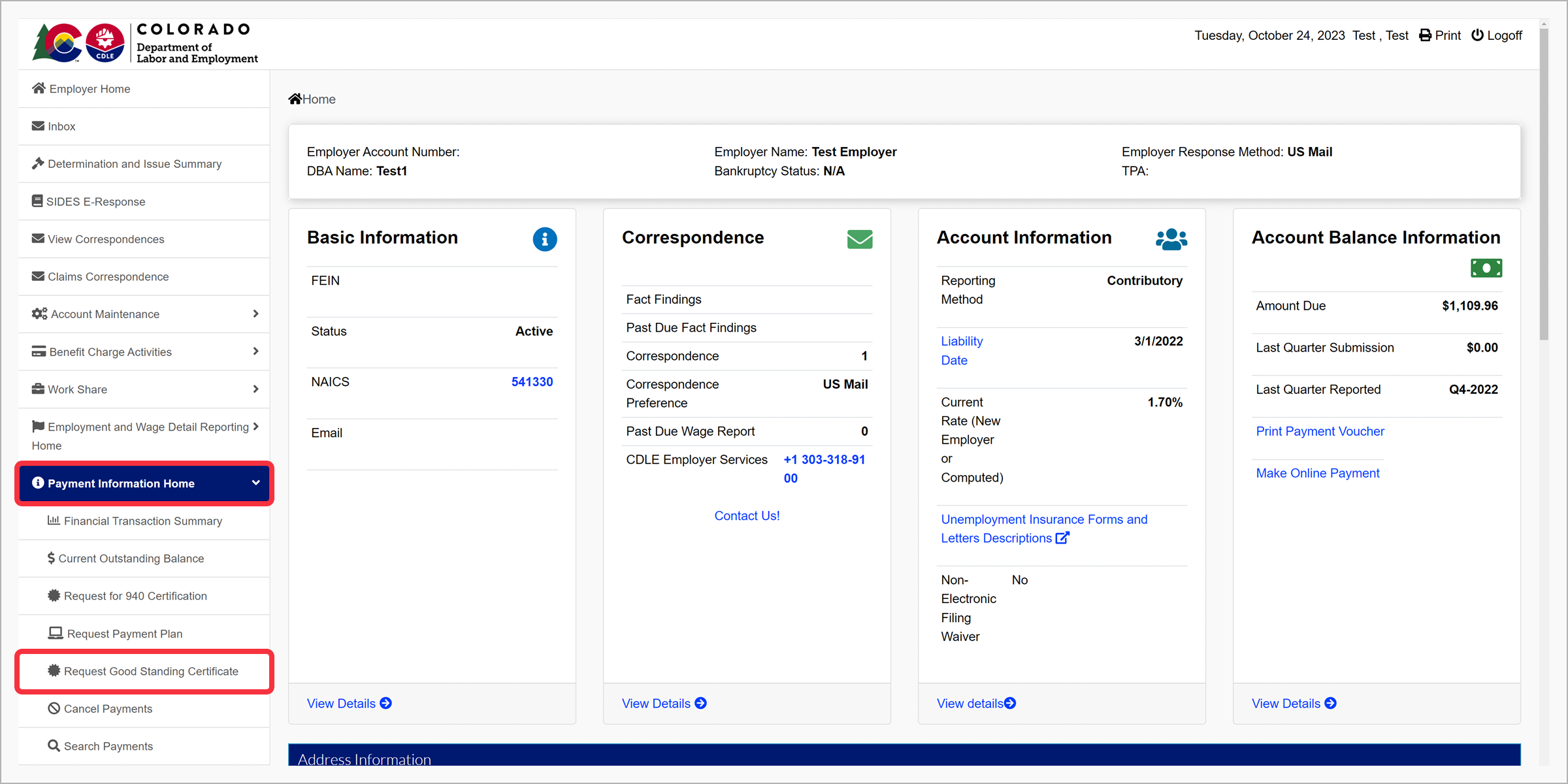

To Request for 940 certification, click the “Payment Information Home” tab in the left-hand navigation menu. Click the “Request for 940 Certification” subtab.

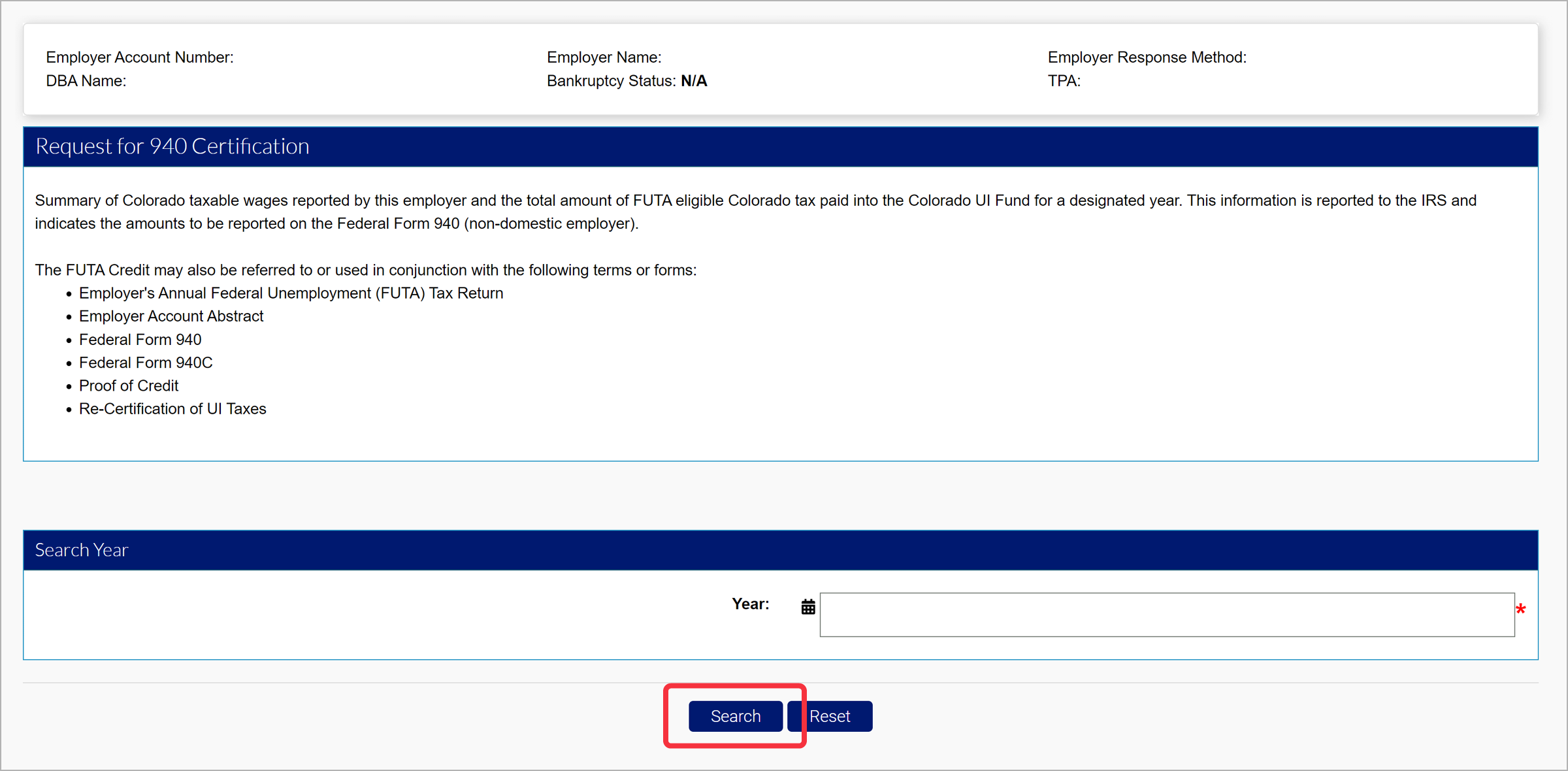

Enter the year you would like the 940 certification for and click “Search”.

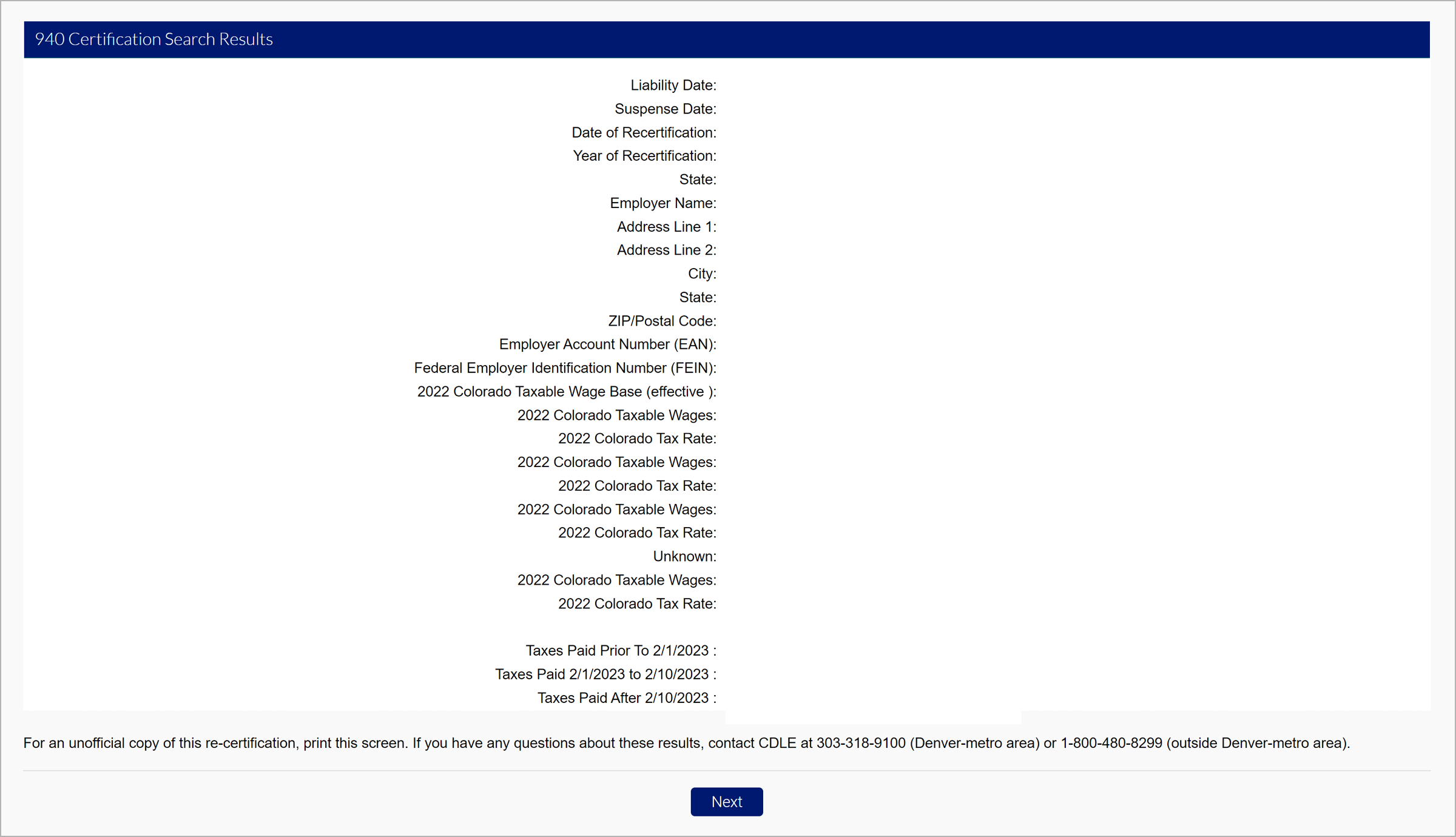

Information for the requested year is displayed in the Search Results screen.

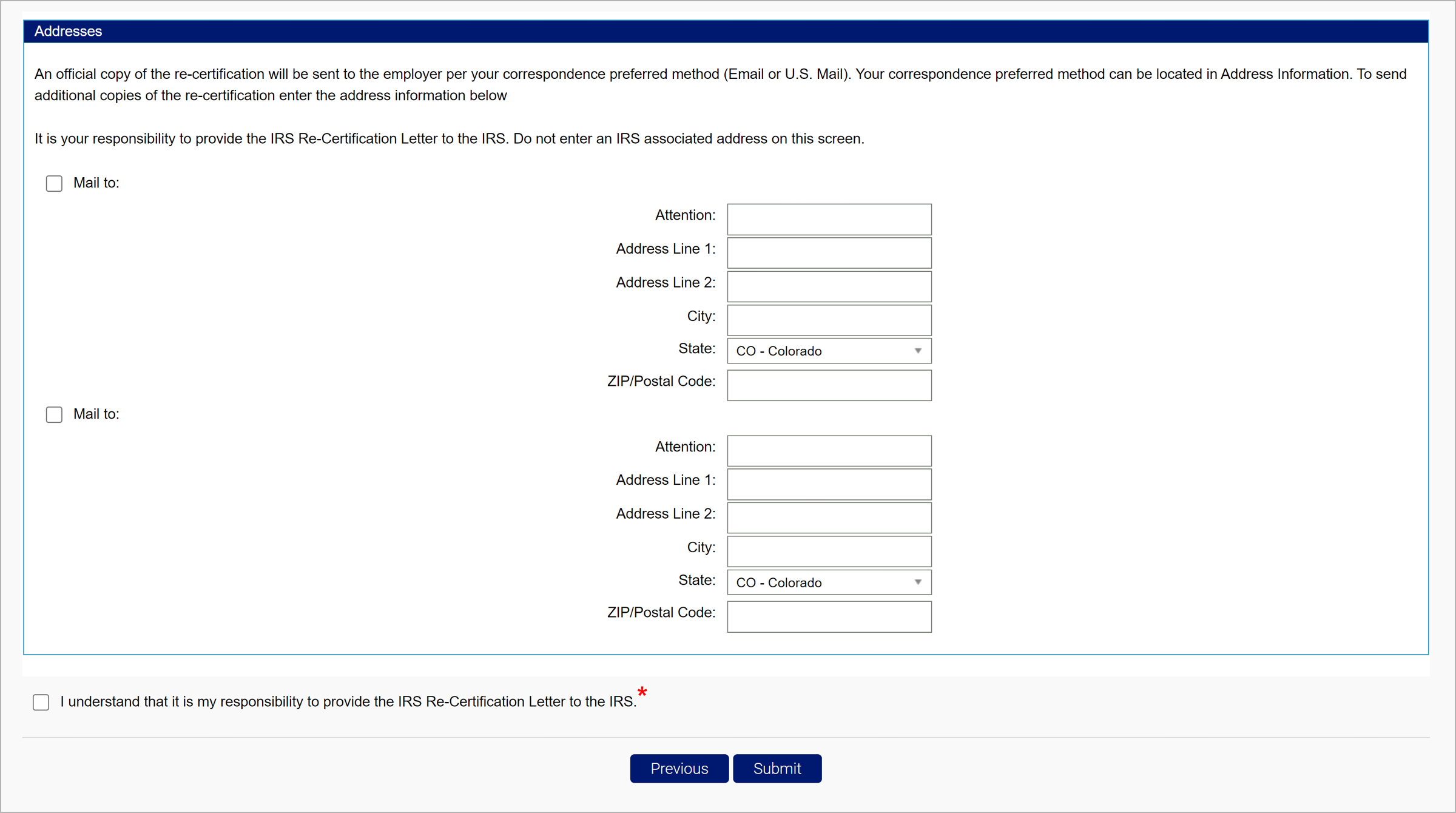

To mail or email an official copy of the 940 Certificate to the employer, Click “Next”. An official copy of the re-certification will be sent to the employer according to the preferred method of communication setting in the account (email or U.S. mail). The preferred method of communication can be located in “Address Information”.

To send additional copies of the recertification, enter the address information on the screen.

NOTE: Do not enter an IRS associated address. It is your responsibility to provide the IRS Recertification Letter to the IRS.

Select the certification checkbox and click “Submit”.

The below confirmation screen will display.