FEIN Corrections

The Federal Employer Identification Number (FEIN) is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to business entities operating in the United States for the purposes of identification.

This number needs to be updated and accurate at all times. If your FEIN needs to be updated or corrected, employers can initiate an FEIN correction inside MyUI Employer+.

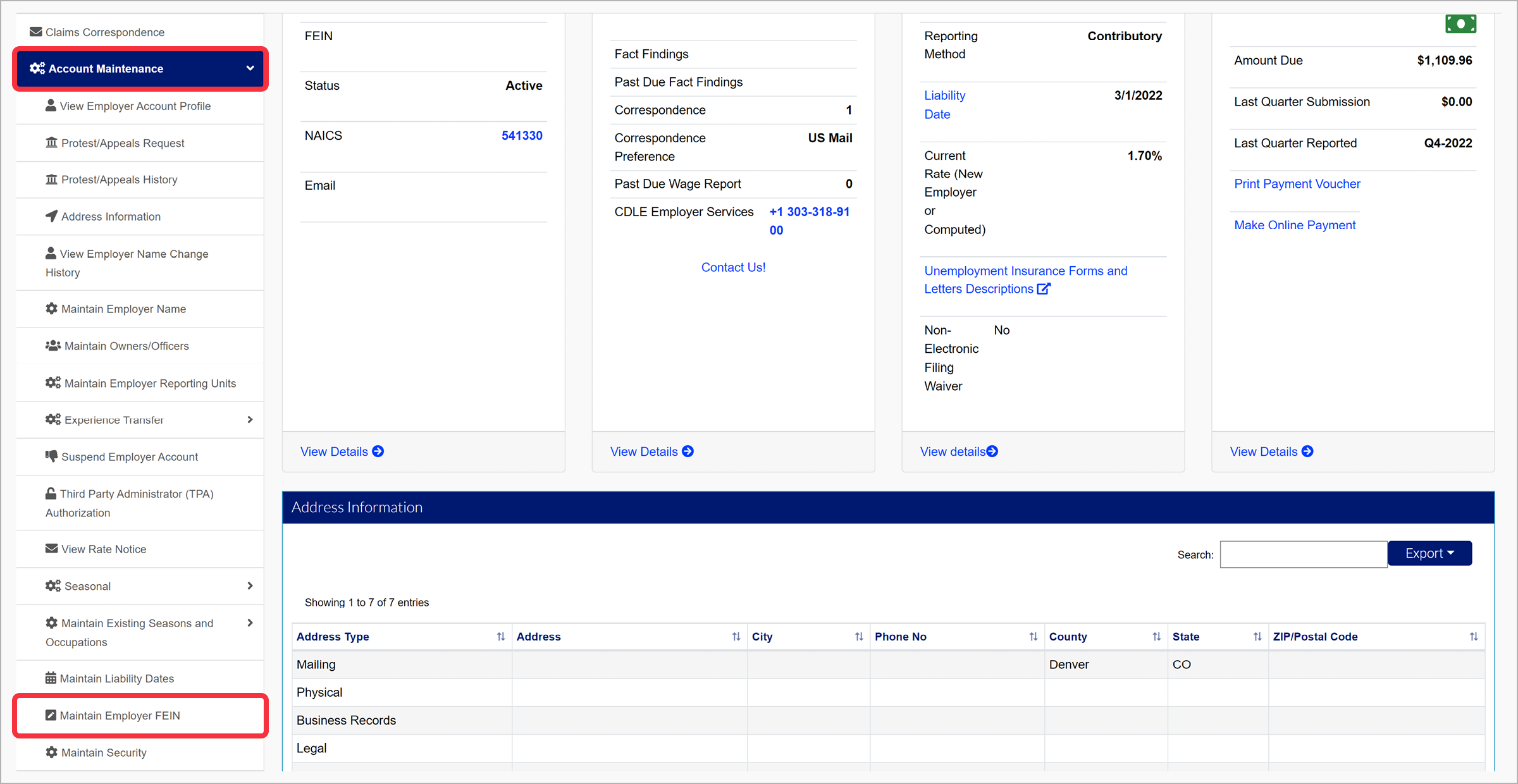

To update an FEIN, navigate to the “Account Maintenance” tab in the left-hand navigation menu. Click the subtab labeled “Maintain Employer FEIN”.

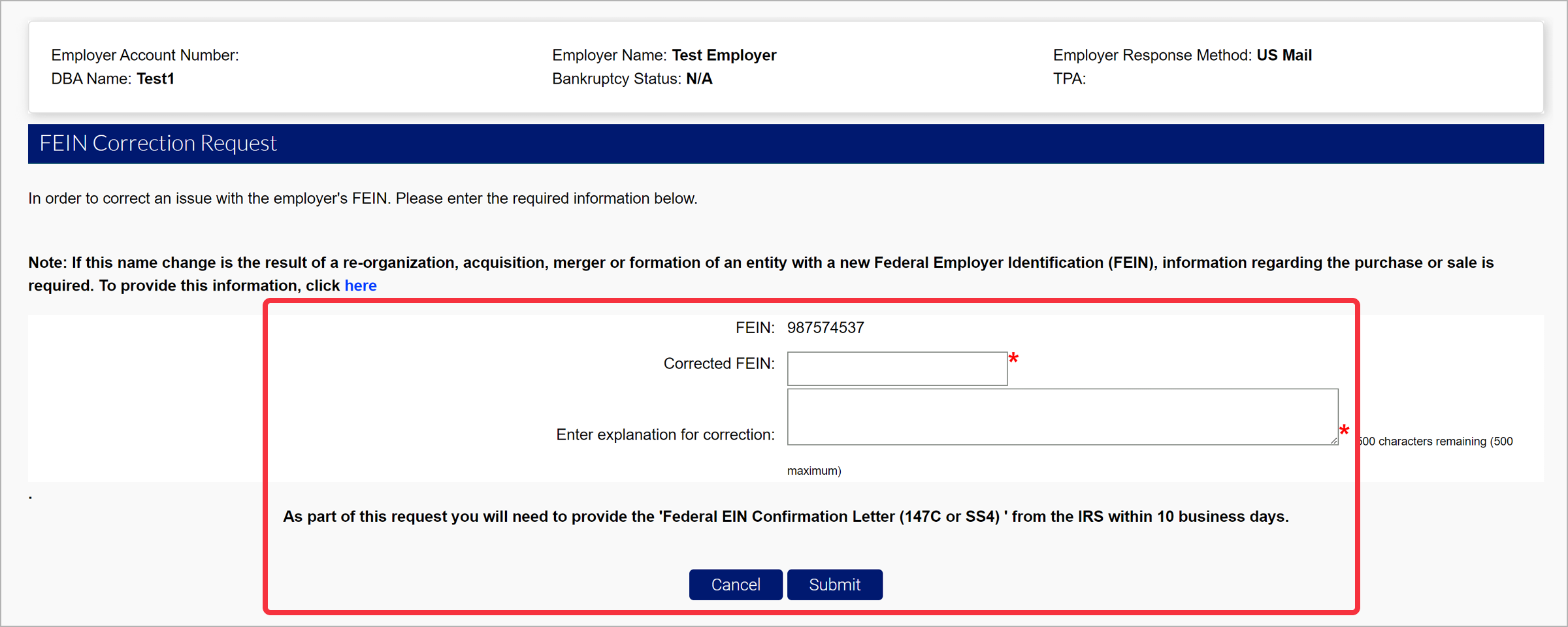

In the FEIN Correction Request, enter the updated FEIN and an explanation for the correction. As part of this request you will need to provide the 'Federal EIN Confirmation Letter (147C or SS4) ' from the IRS within 10 business days.

NOTE: If the FEIN Correction is the result of a reorganization, acquisition, merger or formation of an entity with a new FEIN, information regarding the purchase or sale is required. Click the blue hyperlink link displayed on the screen to provide the Experience Transfer information.

Once the required information is entered, click “Submit”.

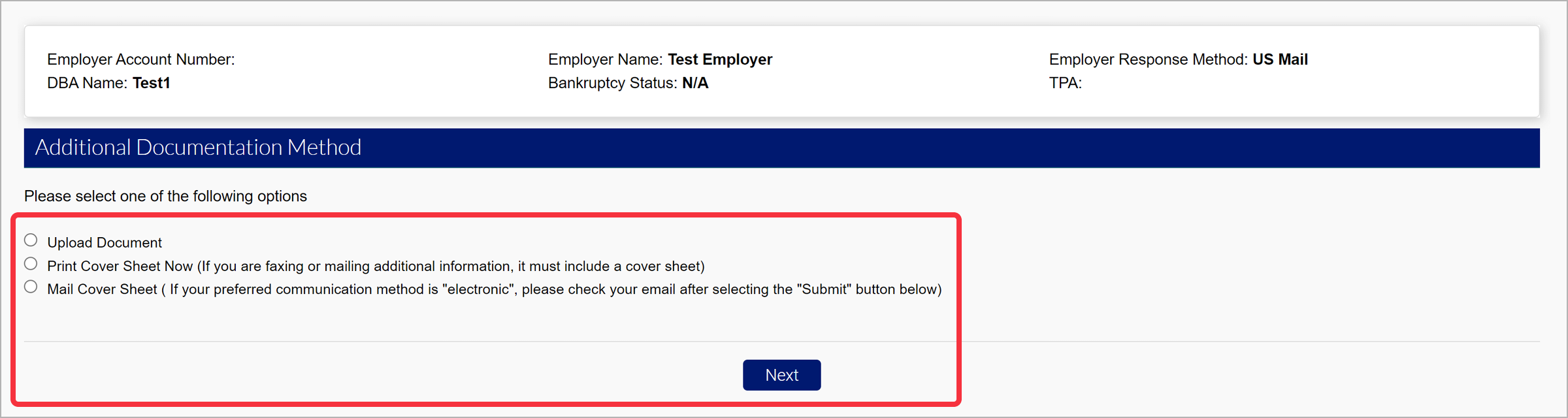

Select an option to upload documentation, mail or fax the required information. A cover sheet can be printed, or you can have the cover sheet mailed directly to your business.

Click “Next”.

When uploading a document, the file cannot be larger than 20 MB. The following formats are acceptable:

- .bmp

- .gif

- .png

- .jpeg

- .tif

- .tiff

A confirmation message will display. The request will be reviewed by CDLE once the proper documentation is received. Employers will be notified if the request is approved or denied. If no documentation is received, the request will be denied.