Interest and Penalties

Penalties and interest will be applied directly to your account in MyUI Employer+ and can be viewed in the “Financial Transaction Summary” screen.

Penalties:

Employer accounts are assessed a $50 penalty for each quarter a Unemployment Insurance Report is delinquent. If the employer is a newly liable employer, the penalty is $10 for each occurrence during the first four quarters of coverage.

If an employer accounts owes delinquent premiums as of the annual computations date (June 30), the account is assessed a delinquent premium penalty equal to the amount of past-due premiums, or 1 percent (0.01) of the taxable payroll, whichever is less. This penalty is billed and payable in four quarterly installments.

Interest:

Interest is charged at a rate of 1.5 percent (0.015) per month, or any portion of a month on past-due premiums and penalties.

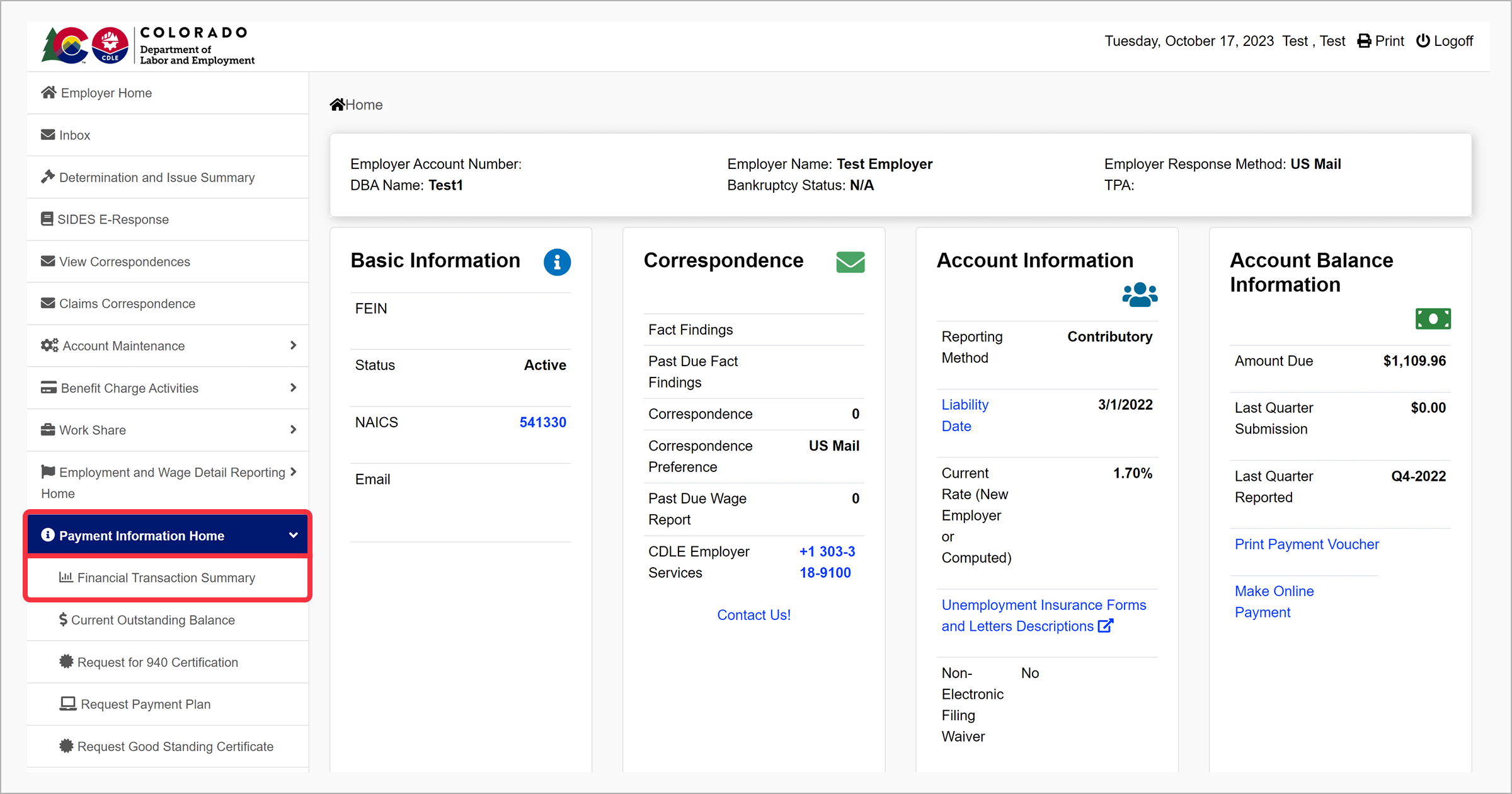

To view information related to penalties or interest, navigate to the left-hand navigation menu and click the “Payment Information Home” tab, then click the “Financial Transaction Summary” subtab.

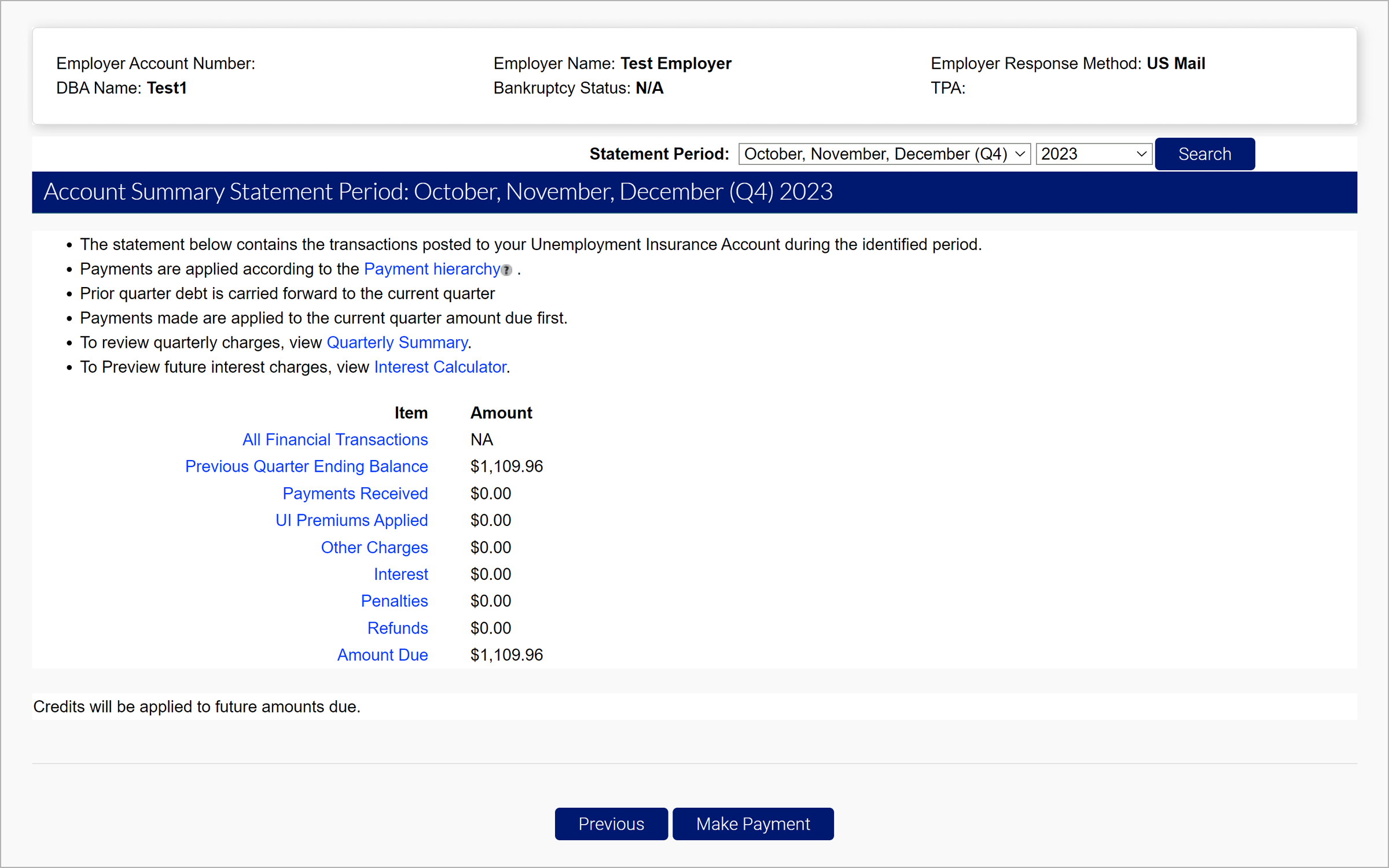

Click the blue hyperlinks for “Interest” or “Penalties” to view the interest or penalties for the selected quarter and year.

Click the “Interest Calculator” to calculate what the interest will be based on the premium payment date.

The Payment hierarchy tooltip states: Payments are applied in a manner as prescribed by the Director of the Division of Unemployment Insurance.