Managing your MyUI Employer+ Account

MyUI Employer+ is a secure online system giving you access to your Unemployment Insurance (UI) account information. Once registered, you’ll be able to easily manage your account, complete required tasks, and access valuable information regarding your UI account.

This guide provides the details you need to find information and complete work using the MyUI Employer+ system. For further assistance, users can request customer service using the “Contact Us'' feature inside the portal.

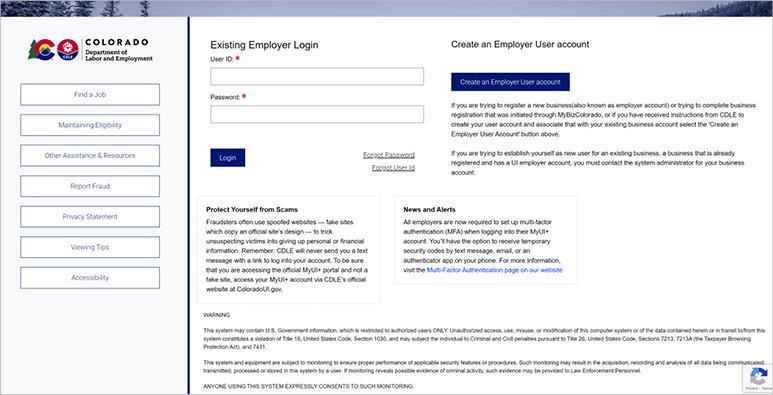

The MyUI Employer+ Welcome Page for employers

Access your account by visiting the MyUI Employer+ Employer login page.

The Welcome Page is where you will create your account, and login once your account is created. If you are registering for a UI account for the first time, click the blue “Create an Employer User account” hyperlink on the right-hand side.

Once your account is created, enter your new User ID and Password and click ‘Login’.

You will be required to login using Multi-Factor Authentication (MFA) in order to safeguard your MyUI Employer+ employer account. MFA provides an extra layer of security to the login process by adding more than one method to verify that a user is the owner of the account.

You will receive a security code via the authenticator application (preferred), a text message, or email that you will need to provide each time you login to your account.

You must create an online User Account and complete an online Employer Account Registration to access your UI account information.

Once your account is registered you may set up additional user accounts for employees that need access. Your TPA, known in the system as a Third Party Administrator or Agent, will manage their own TPA account. TPA roles and permissions are managed inside your employer account. See TPA Accounts for more information.

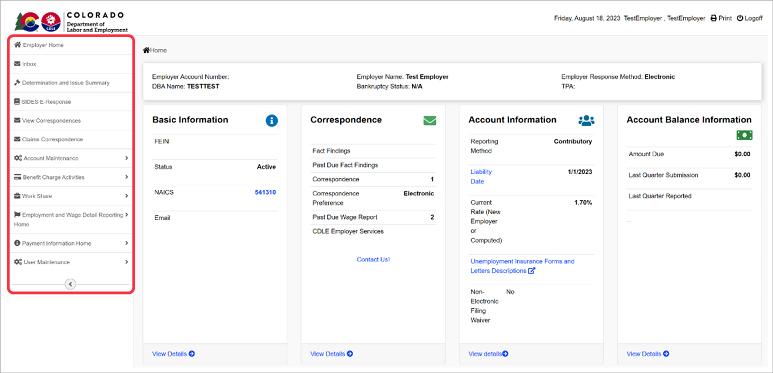

The Employer Home Page

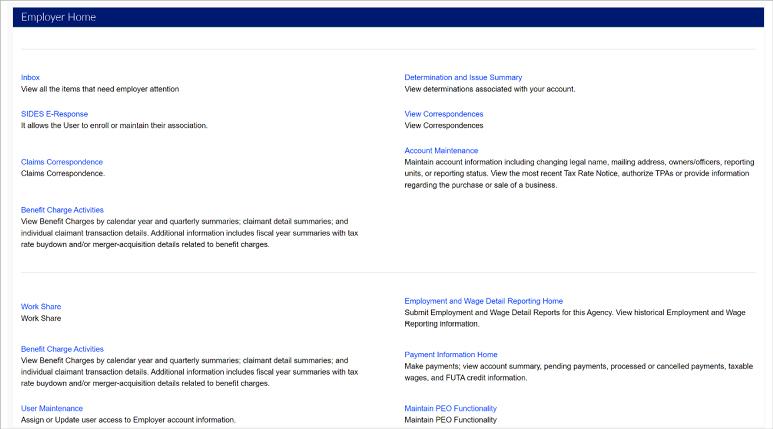

The Left Hand Navigation Menu is the primary navigation method in MyUI Employer+.

- Employer Home - View general information on the Employer Home Page.

- Inbox - View all items that require attention in the employer inbox.

- Determination and Issue Summary - View determinations associated with the account.

- SIDES E-Response - Enroll or maintain SIDES association.

- View Correspondences - View correspondences sent to the employer.

- Claims Correspondence - View correspondences related to claims sent to the employer.

- Account Maintenance - Maintain account information including changing legal name, addresses, owners/officers. reporting units, or reporting status. View the most recent Rate Notice, authorize TPAs or provide information regarding the purchase or sale of a business.

- Benefit Charge Activities - View Benefits Charges by calendar year and quarterly summaries, claimant detail summaries, and individual claimant transaction details.

- Work Share - Apply or manage the Work Share program.

- Employment and Wage Detail Reporting Home - Submit employment and wage detail reports and view historical information.

- Payment Information Home - Make payments, view account summary, view pending, processed, or canceled payments, taxable wages, and FUTA credit information.

- User Maintenance - Assign or update user access to the employer account.

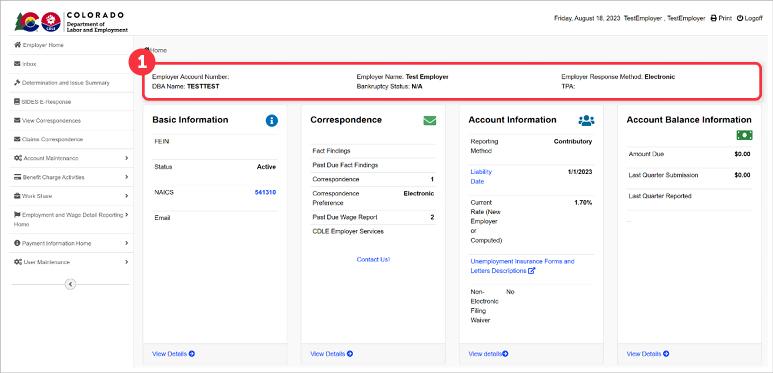

- Once logged in, users are brought to the Employer Home Page. Employer account information is located at the top of the page, including:

- Employer Account Number (EAN) - The number assigned to you for your account when you register with CDLE.

- DBA Name - The Doing Business As name.

- Employer Name - The legal employer name.

- Bankruptcy Status - The employer’s bankruptcy status. As a default, the bankruptcy status will display N/A. If the employer has filed for bankruptcy with CDLE, the bankruptcy status will show the status options Pending, Dismissed, or Discharged.

- Employer Response Method - The preferred claims response method for the employer. Options include Electronic, Paper Mail, and SIDES.

- TPA - The TPA ID(s) for the TPA(s) associated with the employer, if the employer has elected TPAs.

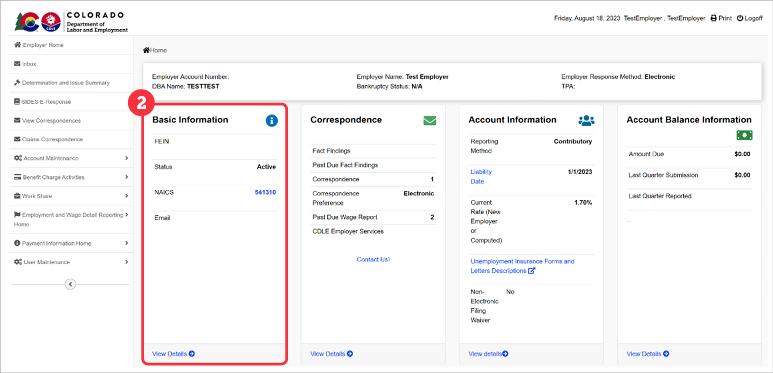

- The Basic Information section includes:

- FEIN - The employer’s Federal Employer Identification Number. Employers obtain this number from the federal government.

- Status- The account status with CDLE.

- NAICS - The NAICS code assigned to the employer. Hovering over the blue hyperlink generates a description of the employer’s specific NAICS code.

- Email - The employer email address.

Click the ‘View Details’ link to access more account information.

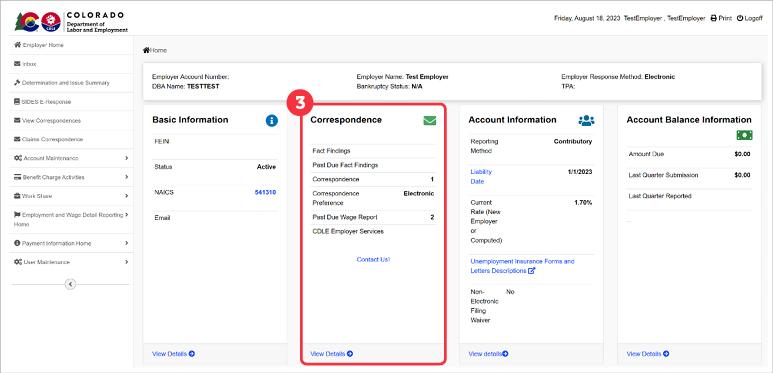

- The Correspondence section includes:

- Fact Findings - The total number of fact findings on the employer account.

- Past Due Fact Findings - The total number of past due fact findings on the employer account.

- Correspondence - The total number of correspondences that have been sent to the employer account.

- Correspondence Preference - The correspondence preference identified by the employer. Options include Electronic and Paper Mail.

- Past Due Wage Report - The number of past due wage reports.

- CDLE Employer Services - The phone number to reach CDLE Employer Services.

- Contact Us! - Clicking the blue hyperlink brings the user to a screen to fill out a Contact Us request. Submitted inquiries are sent directly to appropriate division staff. See Contact Us section for more information.

Click the ‘View Details’ link to view the Correspondence Search page.

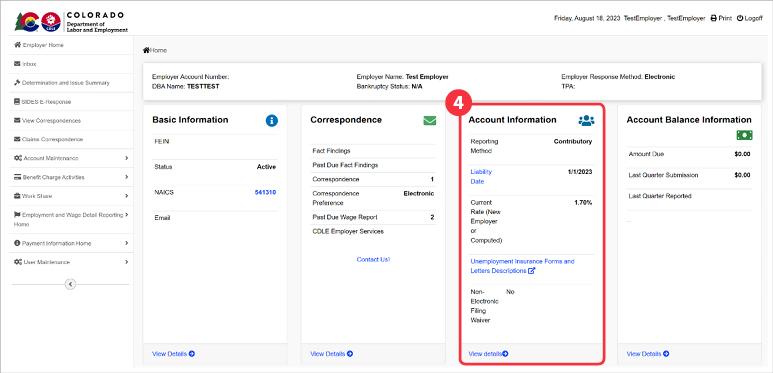

- The Account Information section includes:

- Reporting Method - The reporting method for the employer.

- Liability Date - The first date the employer is liable. The Liability Date blue hyperlink will display “The liability date refers to the first date the employer became liable.”

- Current Rate (New Employer or Computed) - The current rate set for the employer. Current Rates are calculated based on the employer information provided during account registration.

- Unemployment Insurance Forms and Letters Descriptions - This hyperlink will redirect users to the CDLE Forms and Publications website.

- Non-Electronic Filing Waiver - The status of the non-electronic filing waiver. Employers who wish to conduct business with the UI division by paper mail must apply for a non-electronic filing waiver. Waivers must be renewed annually.

Click the ‘View Details’ link to view rate notice by rate effective period.

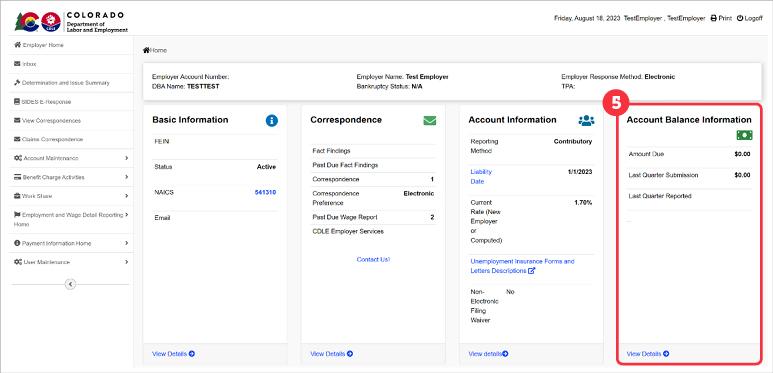

- The Account Balance Information section includes:

- Amount Due - The calculated amount owed by the employer.

- Last Quarter Submission - The total amount of payments submitted in the previous quarter.

- Last Quarter Reported - The quarter and year of the most recent reported wages.

Click the ‘View Details’ link to view a Financial Transaction Summary and sort by quarter and year.

Your address information is also present on the Employer Home Page, including a list of address types, and the address listed for each address type. Addresses can be updated or maintained in the ‘Account Maintenance’ tab.

The employer links at the bottom of the Employer Home Page mirror the Left Hand Navigation menu, and include descriptions for each tab.