9,000 Nonfarm Payroll Jobs Added in December; Unemployment Rate Declines to 4.8%

Household survey data

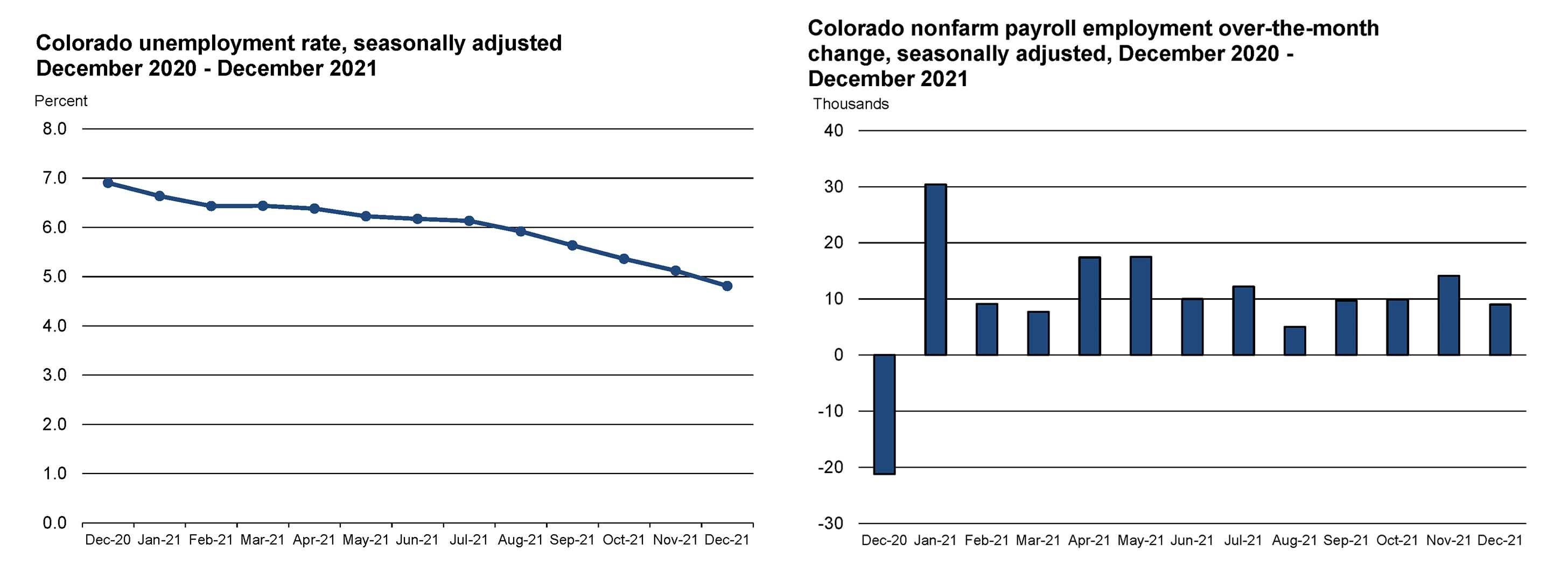

According to the survey of households, Colorado’s seasonally adjusted unemployment rate fell three-tenths of a percentage point in December to 4.8 percent. The national unemployment rate declined by three-tenths of a percentage point to 3.9 percent.

Other highlights from the household survey:

-

Colorado’s labor force increased by 8,500 in December to 3,208,400. The share of Coloradans participating in the labor force improved to 68.3 percent last month. The state continues to experience a faster rate of recovery in the participation rate than the U.S.

-

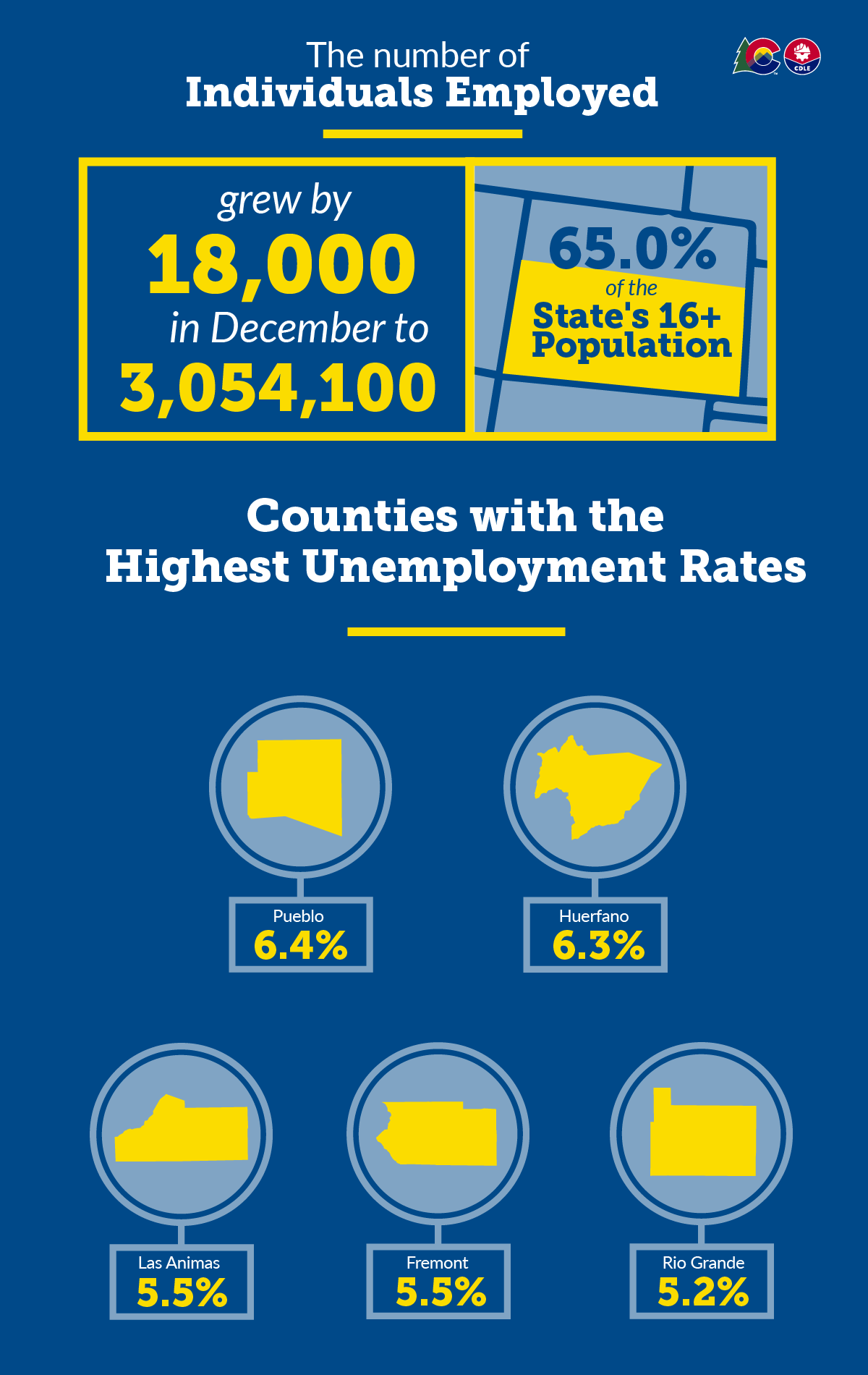

The number of individuals employed in Colorado grew by 18,000 in December to 3,054,100, which represents 65.0 percent of the state’s 16+ population. Colorado’s employment-to-population ratio has trended upward over the past four months.

-

The Colorado counties with the highest unemployment rates in December were: Pueblo (6.4%), Huerfano (6.3%), Las Animas (5.5%), Fremont (5.5%), and Rio Grande (5.2%). County-level unemployment rates are not seasonally adjusted and are directly comparable to Colorado’s December unadjusted rate of 4.1 percent.

Establishment survey data

Employers in Colorado added 9,000 nonfarm payroll jobs from November to December for a total of 2,778,700 jobs, according to the survey of business establishments. Private sector payroll jobs increased 7,900 and government added 1,100 jobs. Over the past 20 months, Colorado has gained back 335,500 of the 375,800 nonfarm payroll jobs lost between February and April of 2020. That translates to a job recovery rate of 89.3 percent, which exceeds the U.S. rate of 84.0 percent.

Other highlights from the establishment survey:

-

November estimates were revised up to 2,769,700, and the over the month change from October to November was a gain of 14,100 rather than the originally estimated increase of 9,800 (monthly revisions are based on additional responses from businesses and government agencies since the last published estimates).

-

Private industry sectors with significant job gains in December were: professional and business services (~1,900), financial activities (~1,200), manufacturing (~1,000), and other services (~1,000). There were no industries with significant over the month declines.

-

Since December 2020, nonfarm payroll jobs have increased 152,000, with the private sector growing by 139,900 jobs and government adding an additional 12,100 jobs. The largest private sector job gains were in leisure and hospitality (~85,600), professional and business services (~22,000), and trade, transportation, and utilities (~13,000). During that same period, construction (~600) payroll jobs declined. Colorado’s rate of job growth over the past year is 5.8 percent, compared to the U.S. rate of 4.5 percent.

-

Over the year, the average workweek for all Colorado employees on private nonfarm payrolls decreased from 33.5 to 33.2 hours, while average hourly earnings increased from $31.20 to $33.28, nearly two dollars more than the national average hourly earnings of $31.31.

###

All Colorado estimates from the establishment and household surveys, including greater geographic detail, are available at: http://www.colmigateway.com. Estimates for all states and the nation are available at: http://www.bls.gov.

The January 2022 Colorado Employment Situation will be released at 8:00 AM on Monday, March 14, 2022. Revised statewide estimates for 2021 and 2020 and some updated local information will also be released. The full schedule of release dates for calendar year 2022 estimates is available at http://www.colmigateway.com.

###

Technical Notes

This release provides information on industry employment and labor force statistics for December 2021, the most current estimates available from the Colorado Department of Labor and Employment. The reference period for the establishment survey was the pay period that includes the 12th of the month. While the household survey’s reference period typically covers the week that includes the 12th of the month, that shifted to the week that includes the 5th of the month for December. For more information on these infrequent reference week shifts, go to https://www.bls.gov/cps/definitions.htm#refweek. Therefore, this release provides an estimate of Colorado’s employment situation as vaccination rates among the adult population continued to increase and pandemic-related restrictions were relaxed for businesses across the state. Additionally, the December reference weeks overlap a period prior to the spike in COVID-19 case rates for Colorado and the nation due to the emergence of the Omicron variant. For information on Colorado unemployment insurance claims activity and related statistics, visit www.colmigateway.com. For information regarding impacts to Bureau of Labor Statistics data collection and processing during the pandemic, go to https://www.bls.gov/covid19/home.htm.

The unemployment rate, labor force, labor force participation, total employment and the number of unemployed are based on a survey of households. The total employment estimate derived from this survey is intended to measure the number of people employed.

Nonfarm payroll jobs estimates are based on a survey of business establishments and government agencies, and are intended to measure the number of jobs, not the number of people employed. Other series based on this survey include private sector average weekly hours, average hourly earnings and average weekly earnings.

The business establishment survey covers about seven times the number of households surveyed and is therefore considered a more reliable indicator of economic conditions. Because the estimates are based on two separate surveys, one measuring jobs by worksite and the other measuring persons employed and unemployed by household, estimates based on these surveys may provide seemingly conflicting results.

###

Resources Mentioned

Supplemental Information

Labor Force Summary December 2021

City Report December 2021

County Report December 2021

December 2021 Press Release