Adjusting a Wage Report

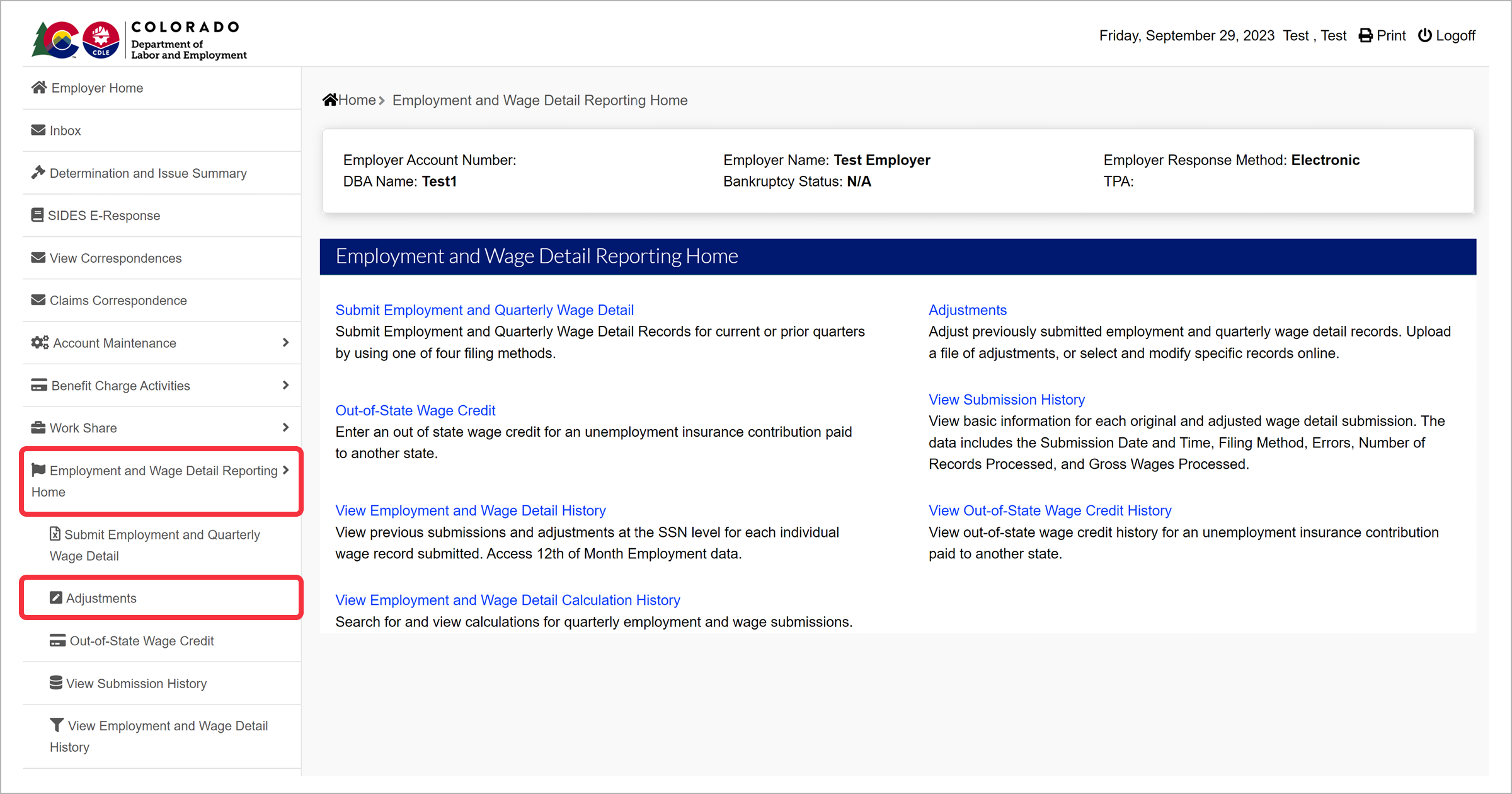

After submitting a wage report, employers can make adjustments to previously reported wages. Select the “Employment and Wage Detail Reporting Home” tab on the left-hand navigation menu. Click the subtab labeled “Adjustments” to begin.

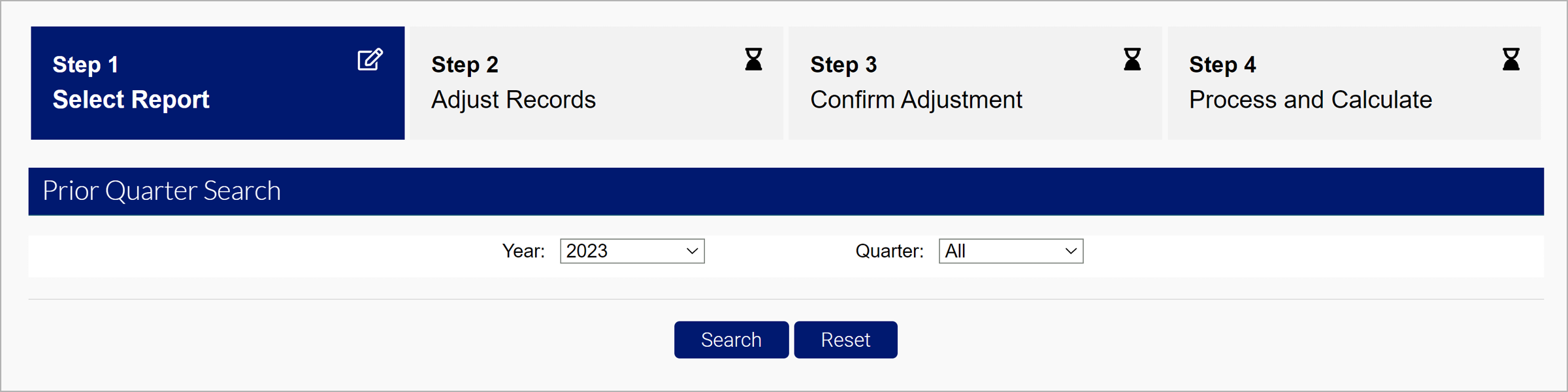

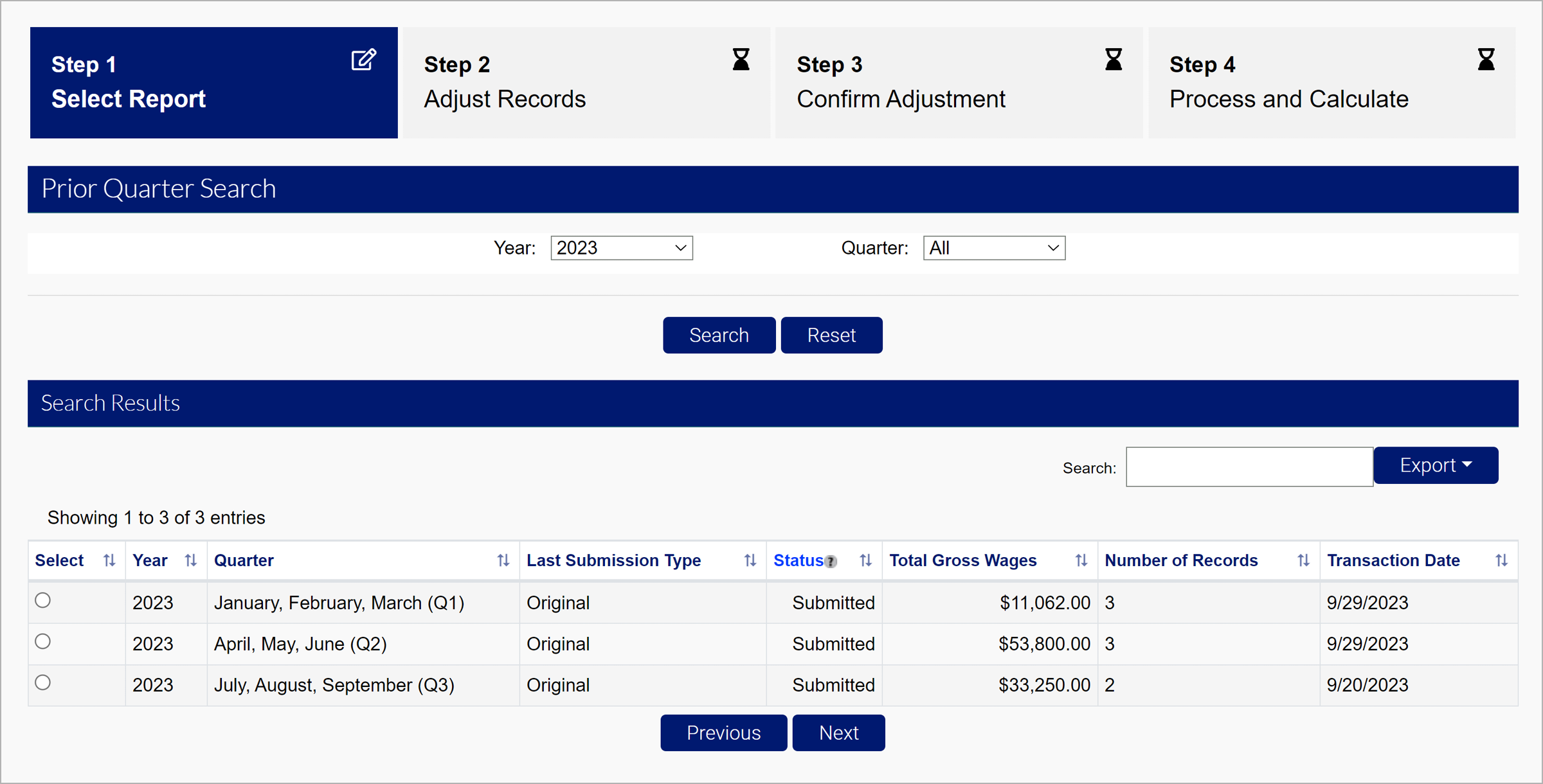

Search for previous quarters to adjust by the year and the quarter in the Prior Quarter Search section.

Select the report you would like to adjust, and click “Next”.

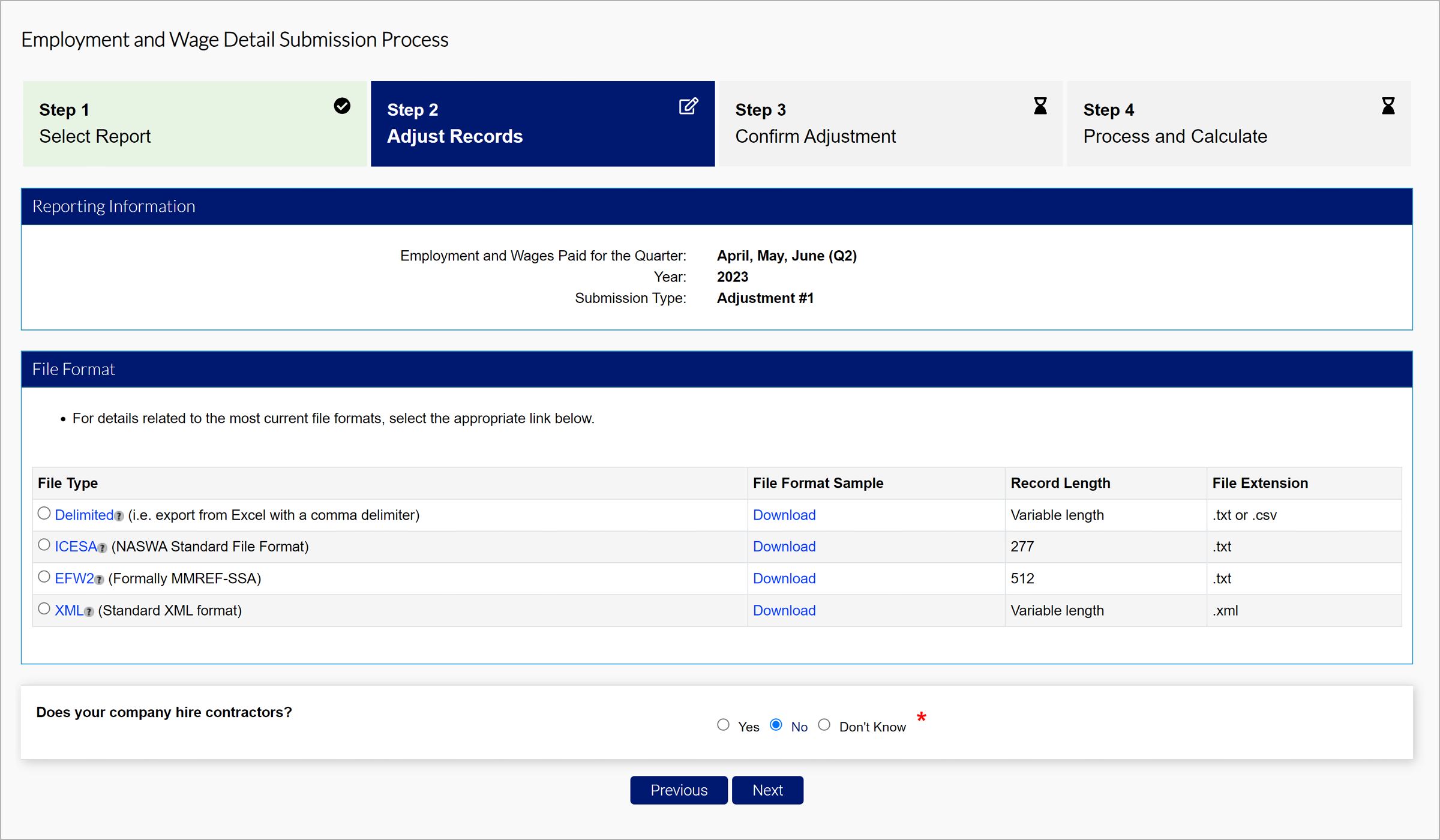

There are three options for your adjustment.

- File Upload - Attach electronic wage file

- Manual Entry - Adjust individual wage records manually online

- No Employment - No wage report

Each of these options will be entered the same way as a typical wage report.

File Upload

Files will be uploaded with the same specifications as the initial report. You can resubmit all wages, include additional employees, or adjustments you want to overwrite in the file.

There are four eligible file types.

- Delimited format - .txt or .csv file that can be exported from Excel. The length of this file will vary and be accepted up to 20MB. Review the Delimited Specifications sheet for more information.

- ICESA format - .txt file in the NASWA standard file format. This will be 277 characters long. Review the ICESA Specification sheet for more information.

- EFW2 format - .txt file formally known as MMREF-SSA. This will be 512 characters long. Review the EFW2 Specification sheet for more information.

- XML format - .xml file that will vary in length and be accepted up to 20MB. Review the XML Specification sheet for more information.

The tooltip over each file type includes an editable PDF of the selected file format.

Select the file type you wish to submit, and click “Next”.

On the adjustment field of the file, identify the reason for the adjustment:

- Employment and Wages adjusted because of incorrectly reported wages.

- Wages adjusted because worker(s)were mistakenly included/excluded.

- Employment and Wages adjusted to correct computer system, data entry or accounting errors.

- Employment and Wages adjusted because they were reported to the wrong state.

- Employment and Wages adjusted because the workers performed services for a different business.

- Employment details adjusted to reflect correct 12th of the month employment information.

- Employment and Wages Adjusted as a result of an Audit

- SSN or name changed

- Other.

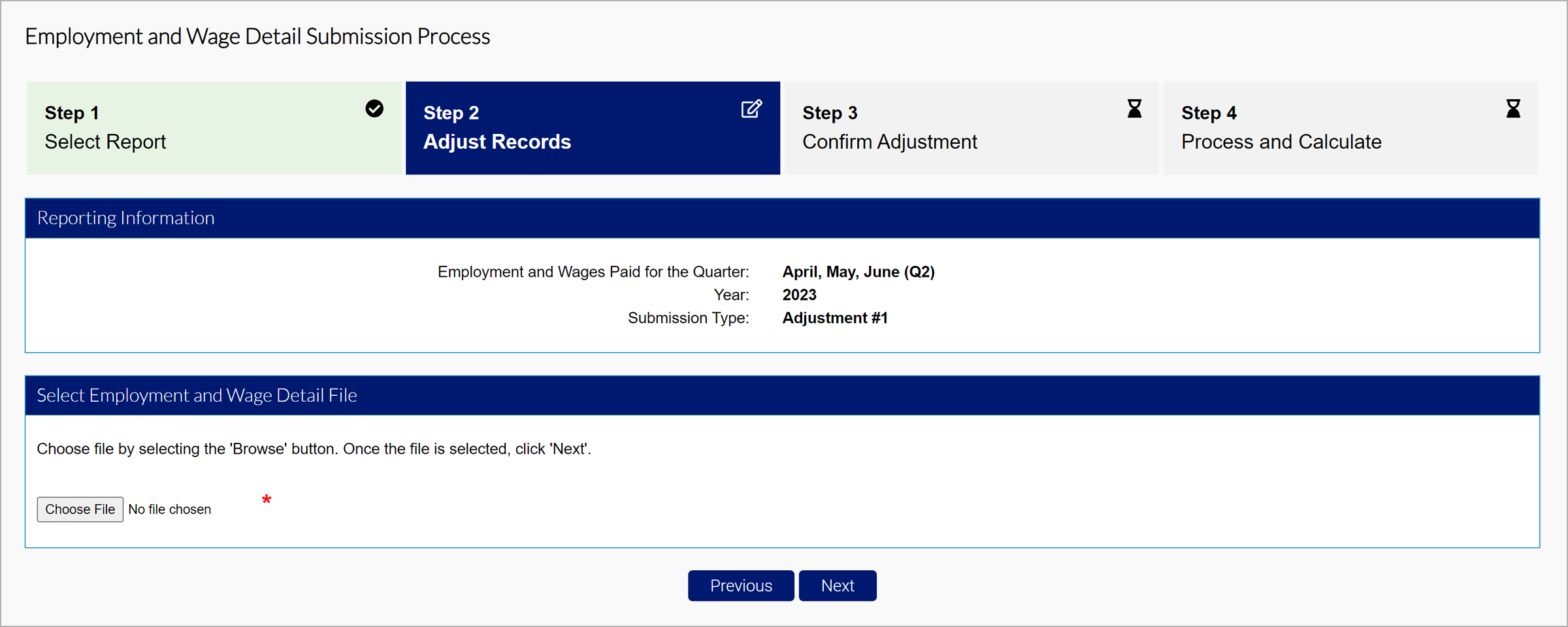

Select the file you would like to attach based on the selected format, and click “Next”.

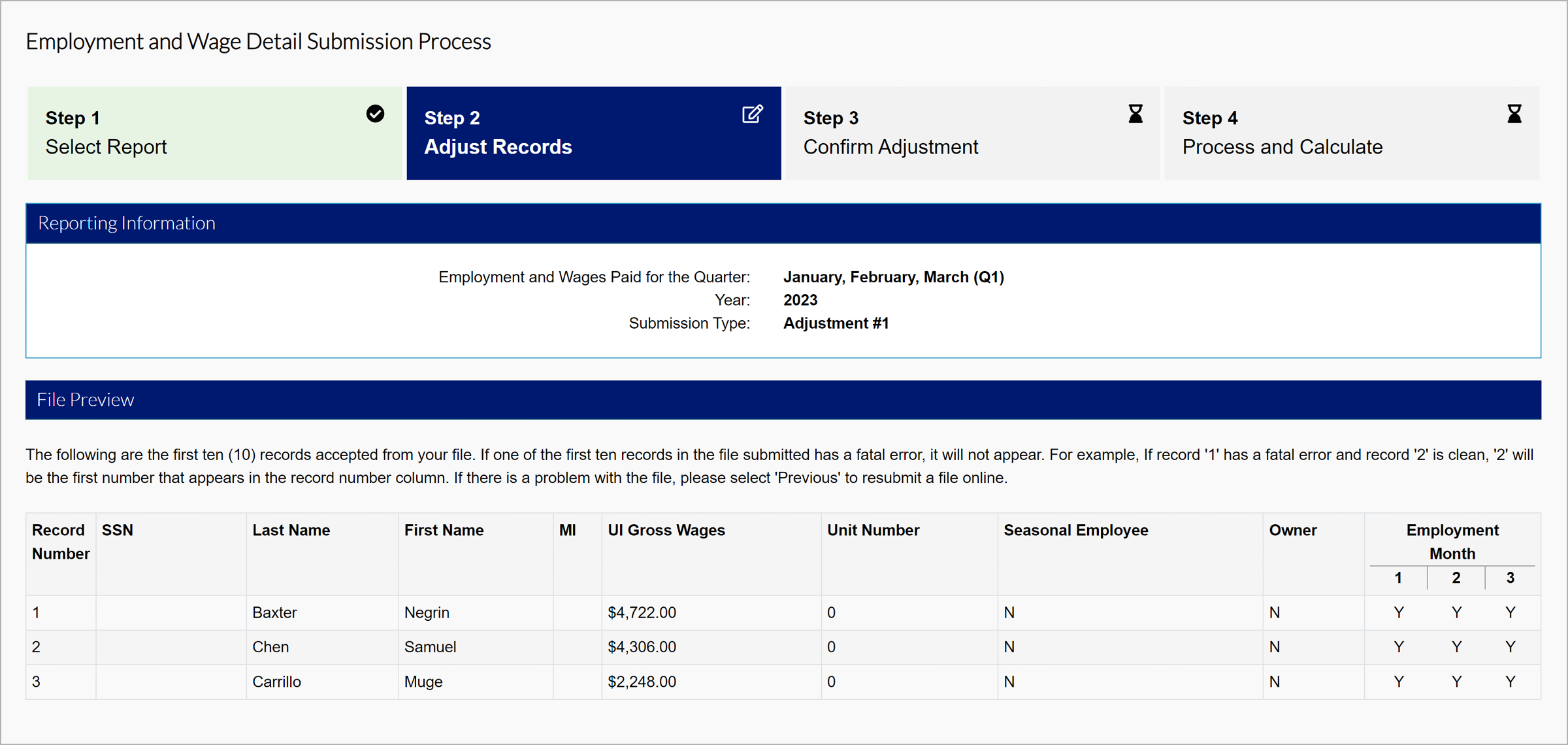

MyUI Employer+ will show the preview of the first 10 records in the file. Click “Next” to proceed.

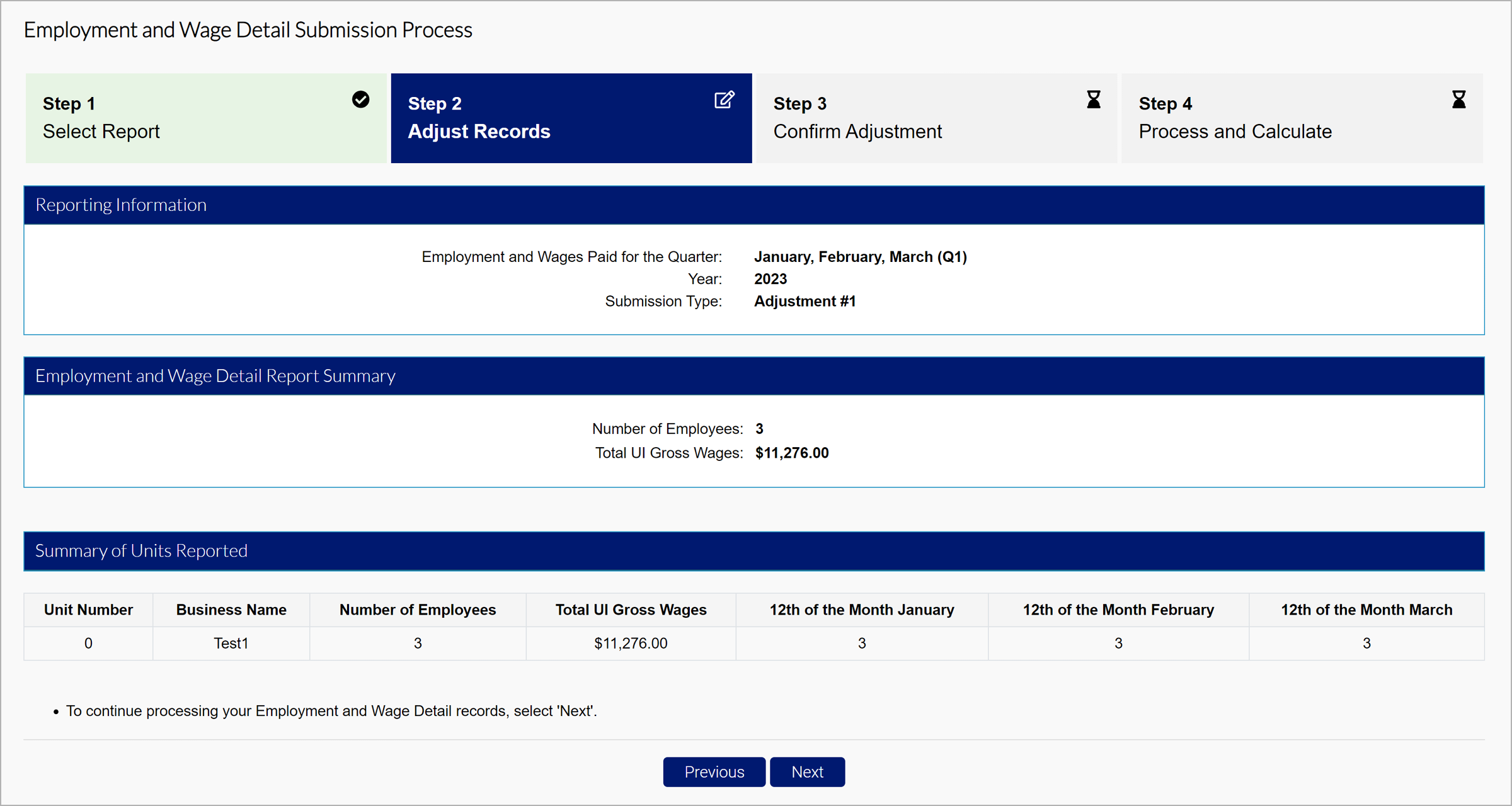

There will be a summary of wages displayed. Click”‘Next”.

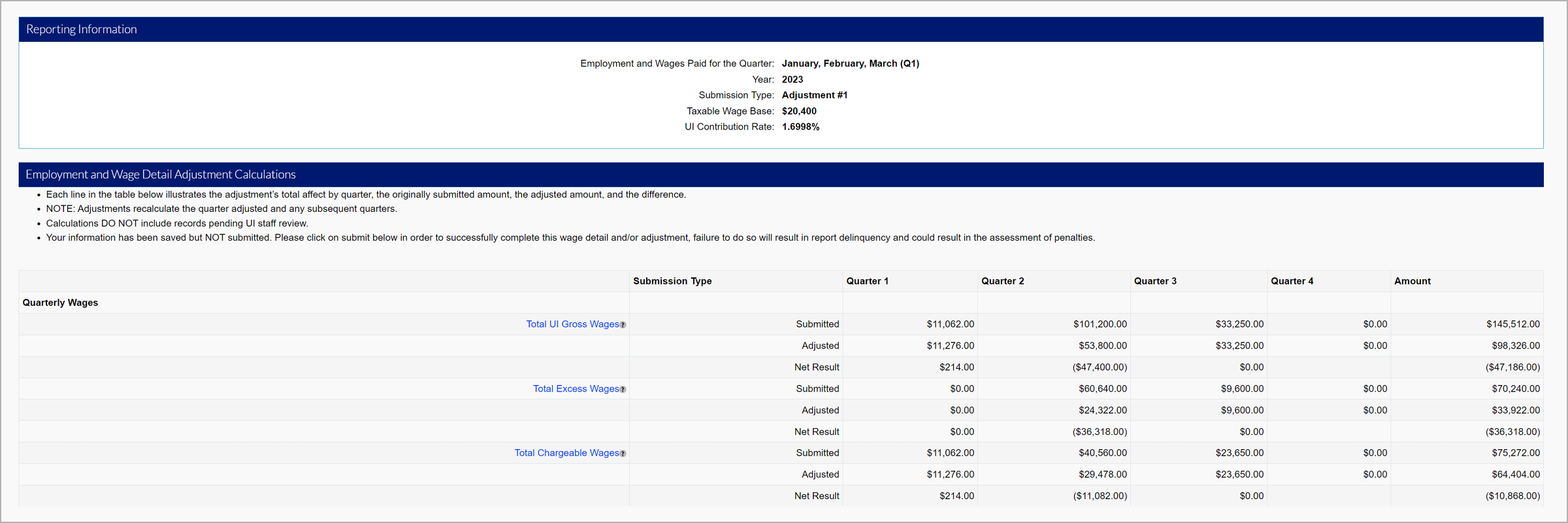

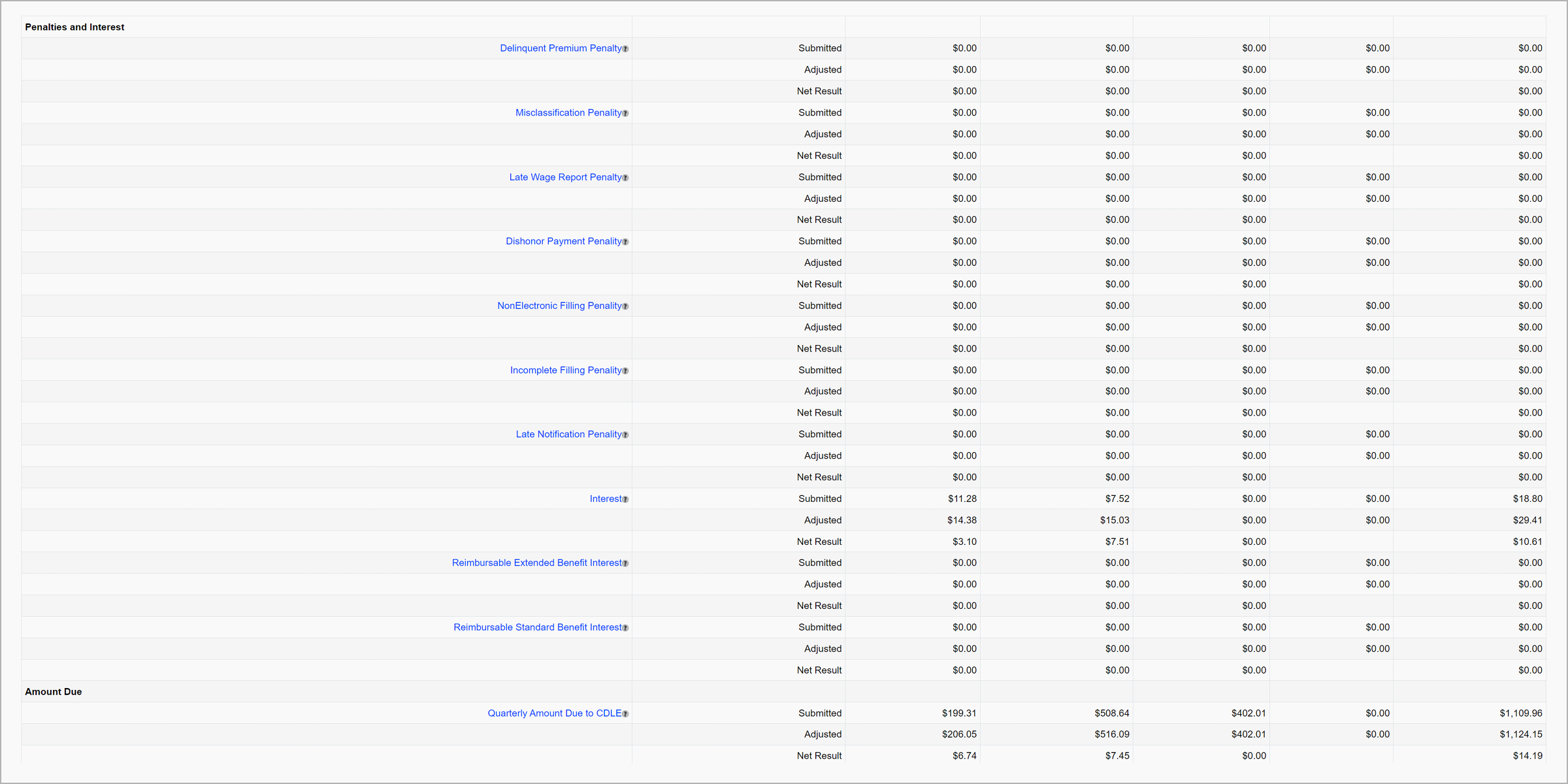

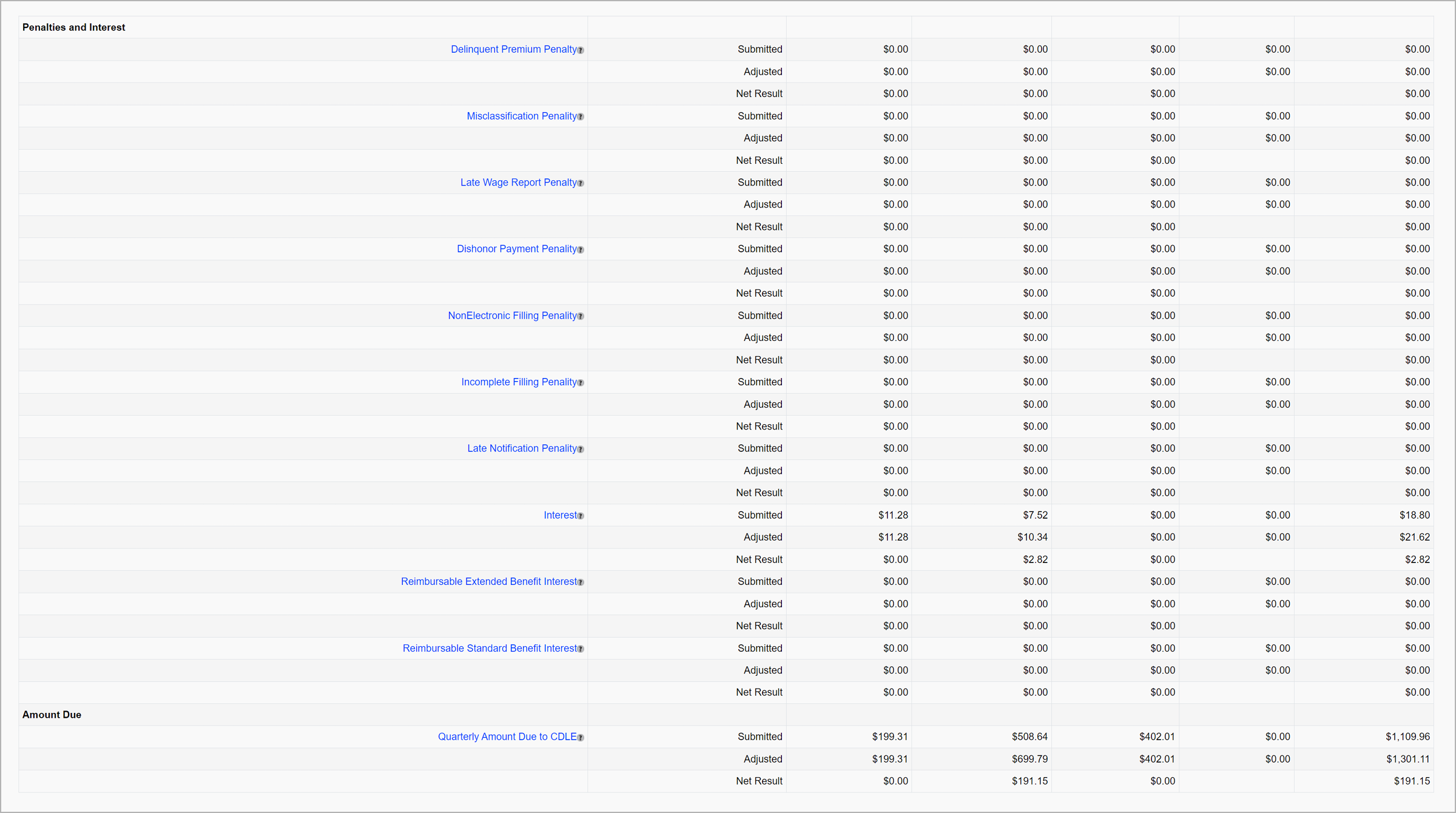

The breakdown will now include the original submission, the adjustment, and the net. You may owe additional premiums, or be provided a refund depending on the adjustment.

The Total UI Gross Wages tooltip states: The sum of all wages paid to the employee for services performed in the quarter being reported.

Wages are payments in cash, goods, or any other medium, whether paid directly or indirectly, to compensate the employee for services performed. Such compensation includes but is not limited to salaries, commissions and bonuses, cash value of housing, meals and lodging, etc.

See the Wage and Hour Laws page on CDLE’s website for a complete definition of wages and payments that are considered to be exempt.

The Total Excess Wages tooltip states: The sum of all wages paid to each employee in excess of the taxable wage base for the year.

The Total Chargeable Wages tooltip states: UI taxable wages are the portion of Total wages paid to an employee over a calendar year which are subject to UI Premiums. This amount never exceeds the wage base for the calendar year.

The Premium Contributions tooltip states: The total amount of premiums due to CDLE for the quarter being reported.

The Employment Support Fund Surcharge tooltip states: The surcharge assessed and appropriated to the Employment Support Fund created pursuant to CESA 8-77-109(1)(b). Payments made to this fund are not included in the calculation of your annual experience rate in accordance with FUTA 26 U.S.C. sec. 3301.

The Benefit Recovery Fund Surcharge tooltip states: The surcharge assessed and appropriated to the Benefit Recovery Fund created pursuant to CESA 8-73-116(2). Payments made to this fund are not included in the calculation of your annual experience rate in accordance with FUTA 26 U.S.C. sec. 3301.

The Employment And Training Technology Fund Surcharge tooltip states: The surcharge assessed and appropriated to the Employment & Training Technology Fund created pursuant to CESA 8-77-109(2)(a.9)(II)(A). Payments made to this fund are not included in the calculation of your annual experience rate in accordance with FUTA 26 U.S.C. sec. 3301.

The Delinquent Premium Payment tooltip states: The penalty assessed when a premium balance remains on an employer account as of June 30 of any year. This penalty amount is equal to either the total premiums overdue or 1 percent (0.010) of chargeable wages from the previous calendar year, whichever is less. The penalty owed is assessed in four (4) quarterly installments in the upcoming calendar year.

The Late Wage Report Penalty tooltip states: The penalty assessed and payable by the employer when quarterly wage reports are not filed on or before the due date as defined by Regulations Concerning Employment Security 6.1.2. This penalty amount is $10 per occurrence for employers newly subject as defined by CESA 8-76-102.5(4) and 8-79-104(1)(a(II)(A), and $50 per occurrence per CESA 8-79-104(1)(a)(II)(A). Employers who are expected to file reports for periods that precede the date of registration will not receive penalty charges if the reports are received within 30 days of account activation.

The Interest tooltip states: The amount we charge if a premium payment is not received by the due date as defined by Regulations Concerning Employment Security 6.1.2. The rate of interest is 1.5 percent (0.015) per month, applied to all interest bearing amounts due. Interest is assessed on the 15th of each month.

The Quarterly Amount Due to CDLE tooltip states: Total amount due to CDLE for the quarter including UI Premiums, Penalties, and Interest.

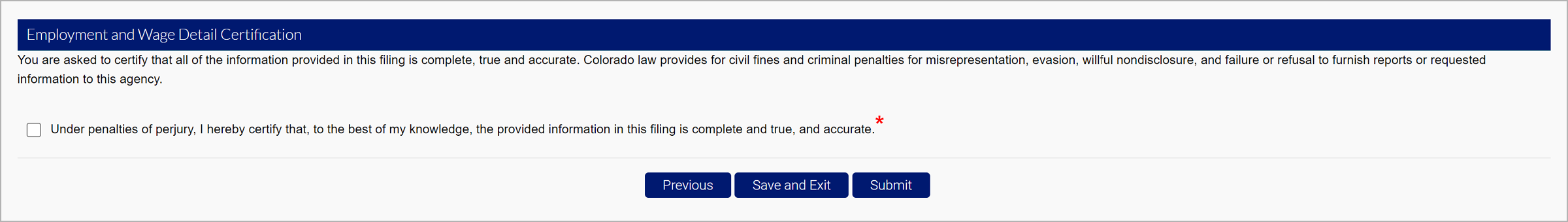

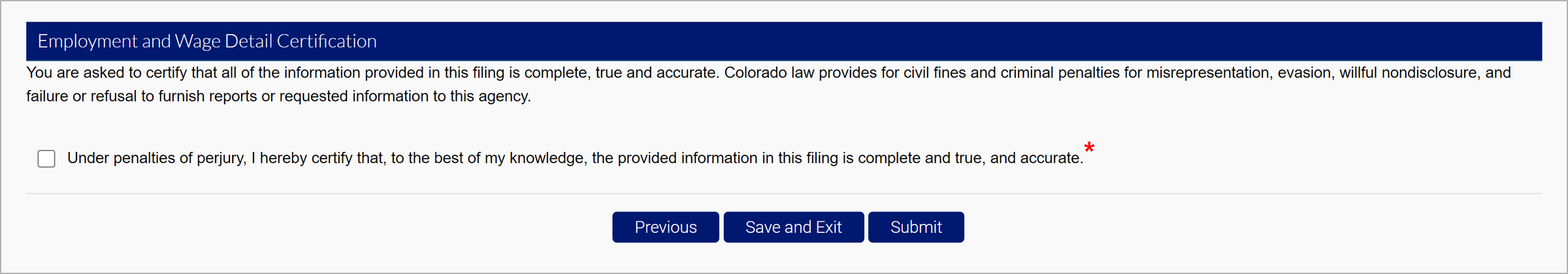

Select the certification checkbox and click “Submit”.

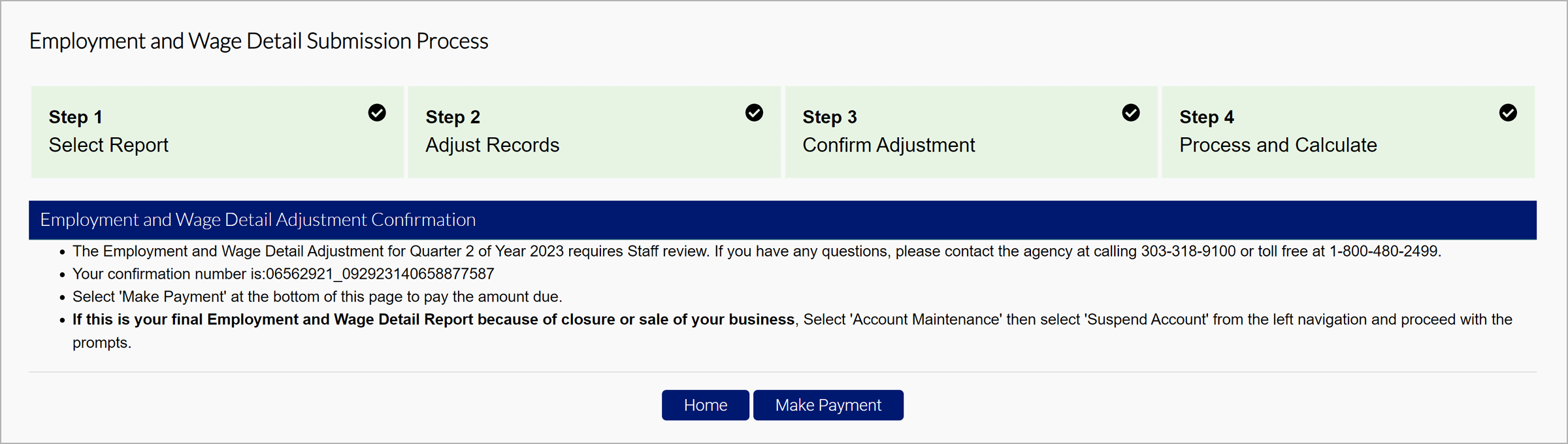

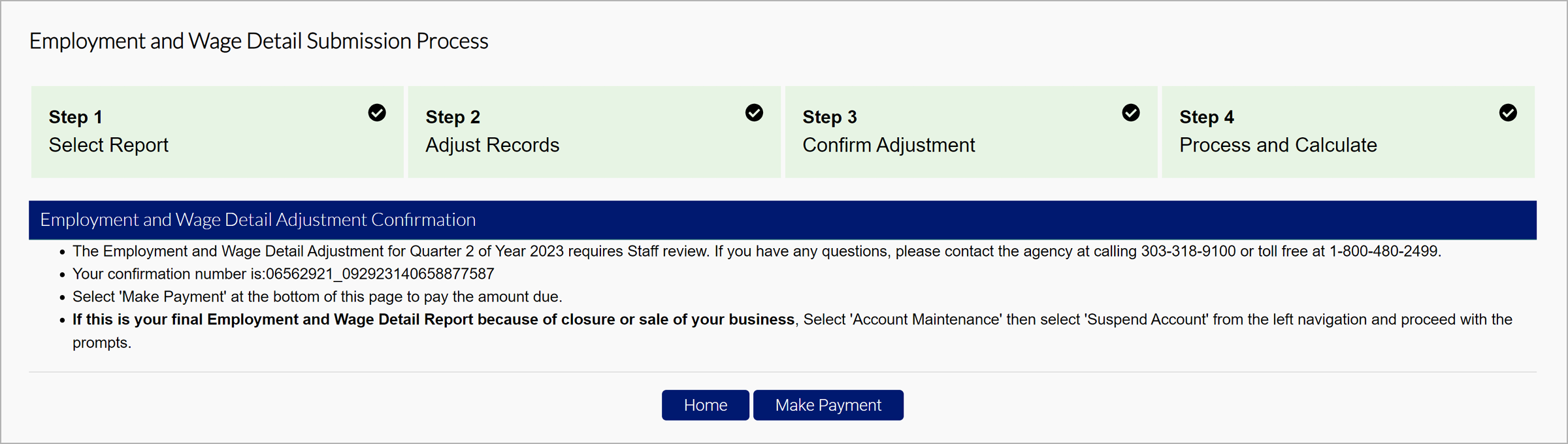

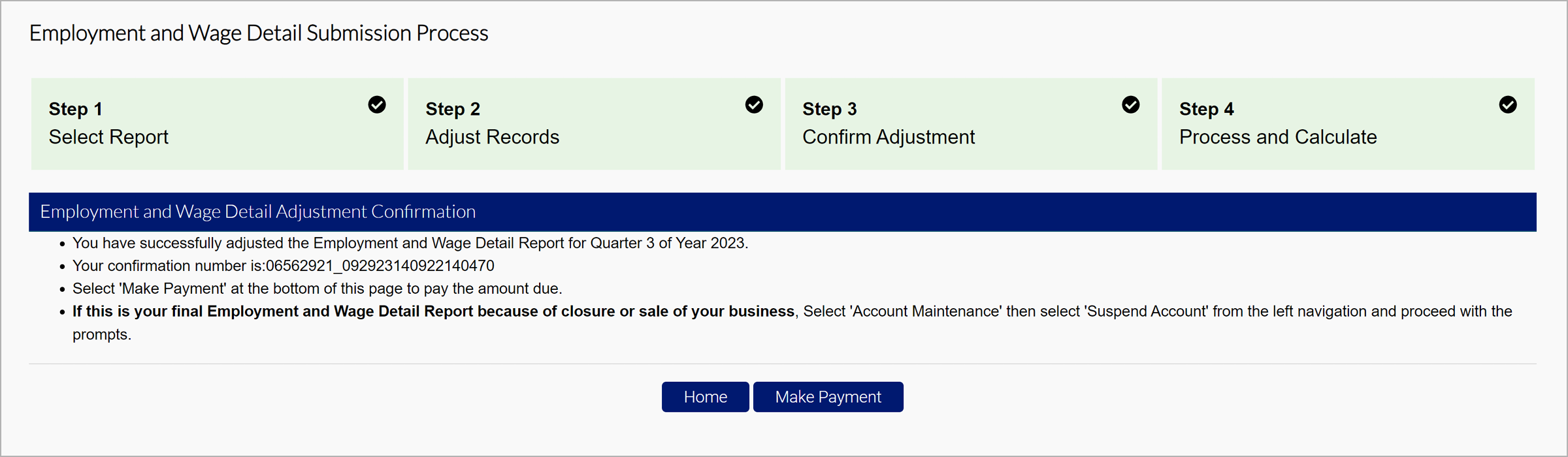

Then, you will be brought to the confirmation page.

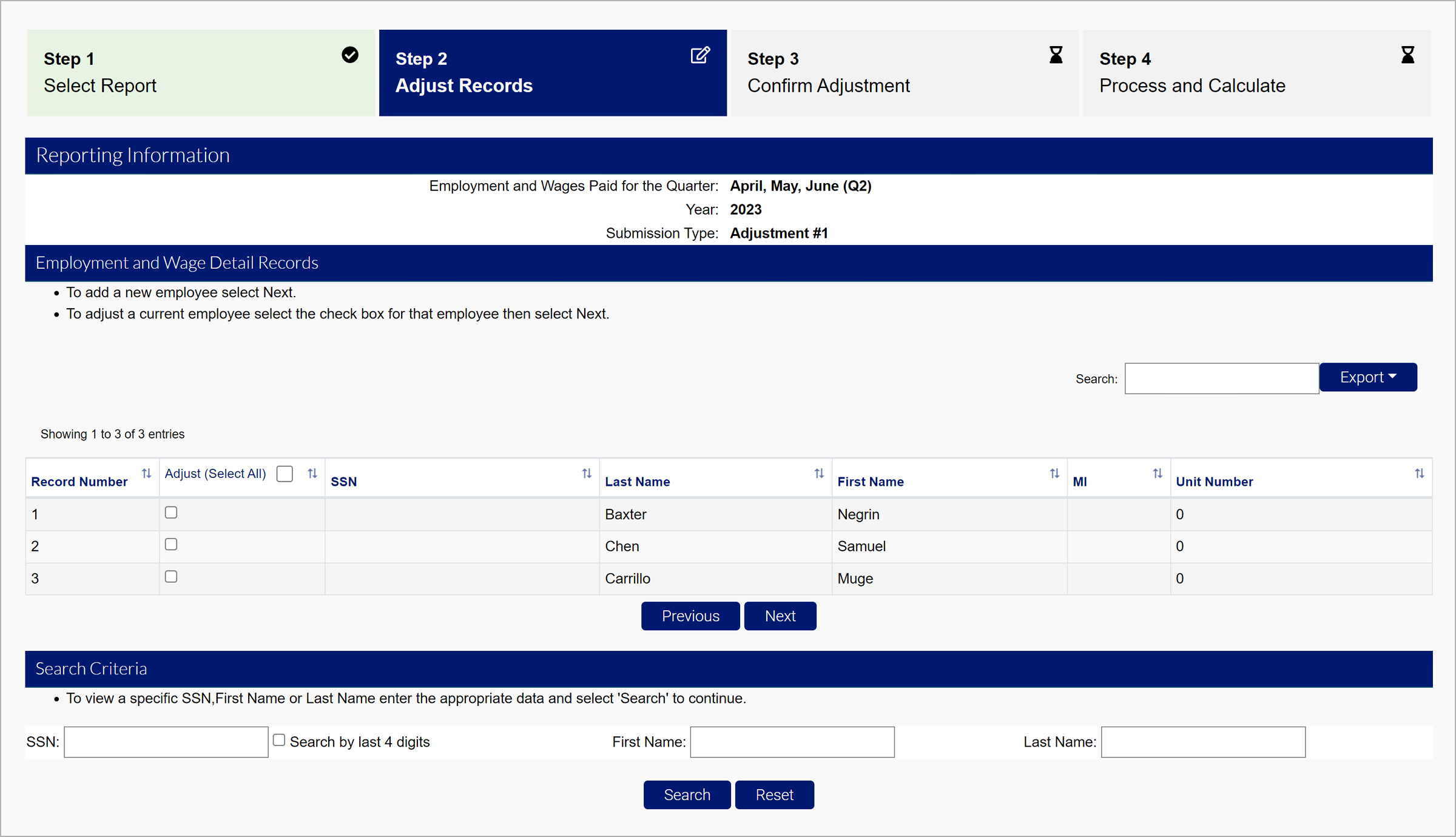

Manual Entry

Select the employees you would like to adjust from the report, if applicable, and click “Next”.

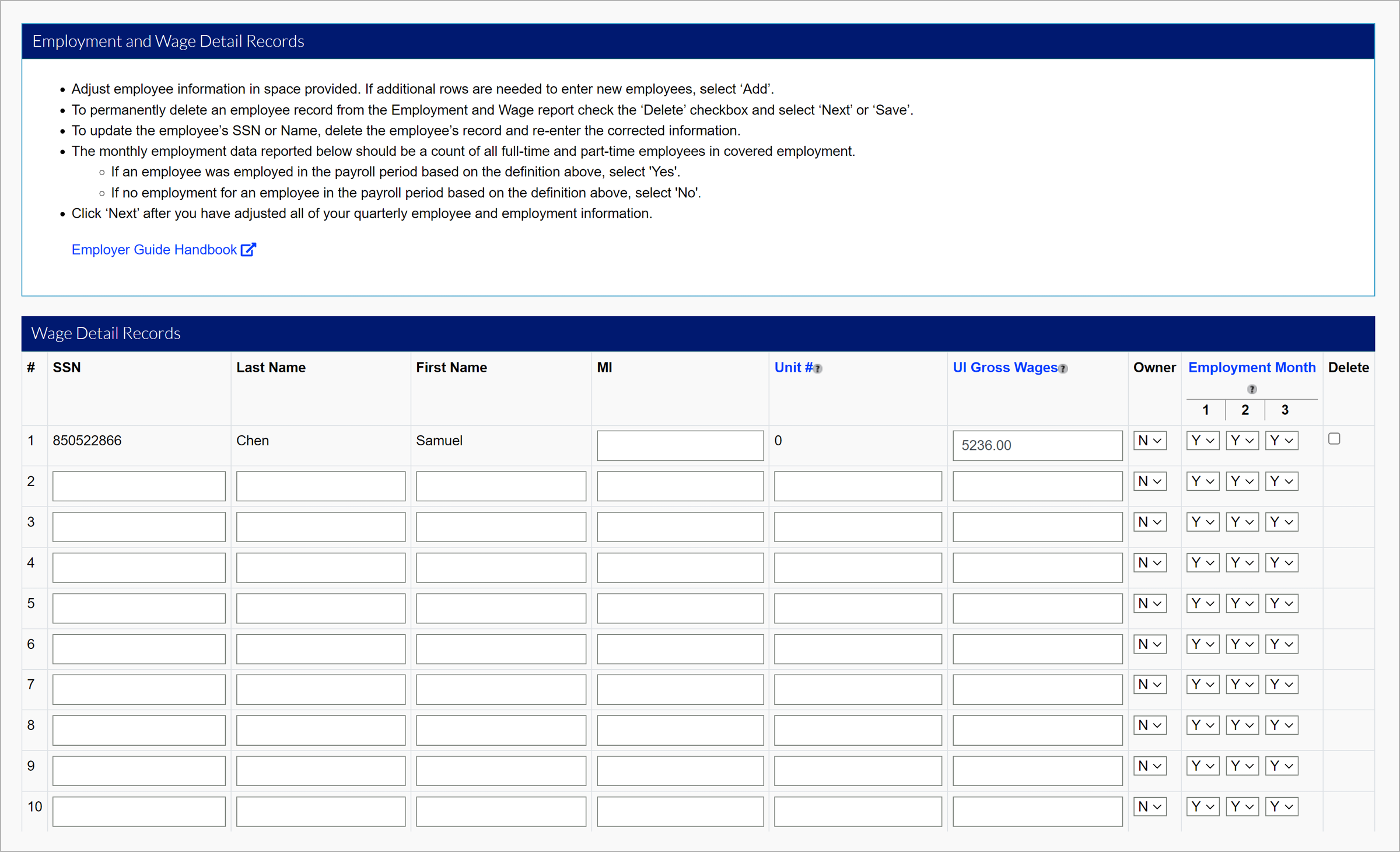

View any selected employees and add additional employees for the adjustment in the Wage Detail Records section.

Adjust employee information in space provided. If additional rows are needed to enter new employees, click “Add”.

To permanently delete an employee record from the Employment and Wage report check the “Delete” checkbox and click “Next” or “Save”.

To update the employee’s SSN or Name, delete the employee’s record and re-enter the corrected information.

The monthly employment data reported below should be a count of all full-time and part-time employees in covered employment.

If an employee was employed in the payroll period based on the definition above, select “Yes”.

If no employment for an employee in the payroll period based on the definition above, select “No”.

Click “Next” after you have adjusted all of your quarterly employee and employment information.

The Unit No tooltip states: An employer may separate the Employer Account into smaller reporting units for Employment and Wage Detail reporting and other organizational purposes. The reporting unit(s) will be assigned a Unit Number. If the business does not maintain separate units leave Unit Number blank.

The UI Gross Wages tooltip states: The sum of all wages paid to the employee for services performed in the quarter being reported. Wages are payments in cash, goods, or any other medium, whether paid directly or indirectly, to compensate the employee for services performed. Such compensation includes but is not limited to salaries, commissions and bonuses, cash value of housing, meals and lodging, etc.

See the Wage and Hour Laws page on CDLE’s website for a complete definition of wages and payments that are considered to be exempt.

The Employment Month tooltip states: The monthly employment data reported below should be a count of all full-time and part-time workers in covered employment(subject to Colorado's Unemployment Compensation Law) that performed services during the payroll period which includes the 12th of the month.

Respond 'Yes' if an employee was employed in the payroll period based on this definition.

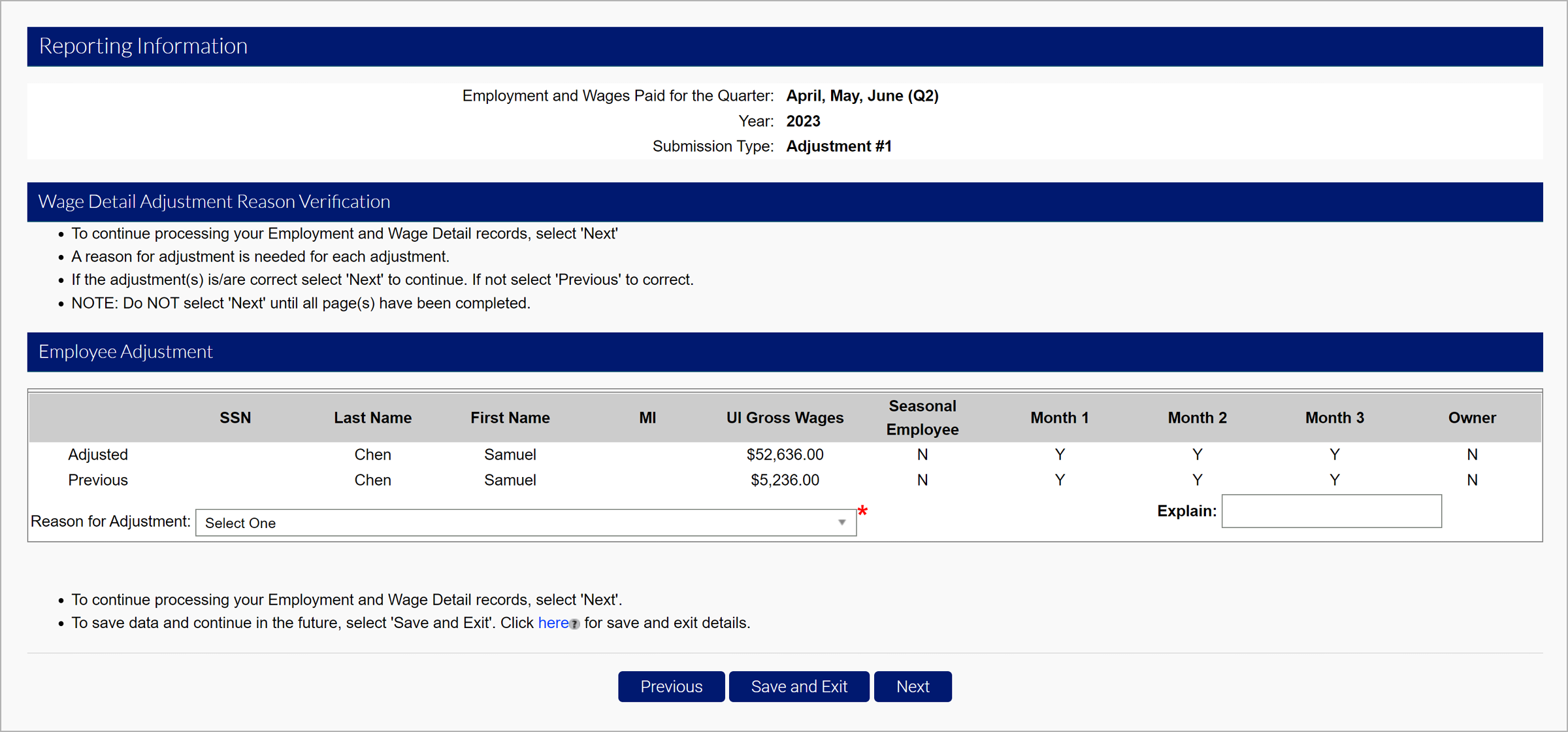

The Wage Detail Adjustment Reason Verification screen will ask for you to enter a reason for adjustment and click “Next”.

- Original Submission

- Employment and Wages adjusted because of incorrectly reported wages.

- Wages adjusted because worker(s) were mistakenly included/excluded.

- Employment and Wages adjusted to correct computer system, data entry or accounting errors.

- Employment and Wages adjusted because they were reported to the wrong state.

- Employment and Wages adjusted because the workers performed services for a different business.

- Employment details adjusted to reflect correct 12th of the month employment information.

- Employment and Wages Adjusted as a result of an Audit

- SSN or name changed

- Fraud

- Other.

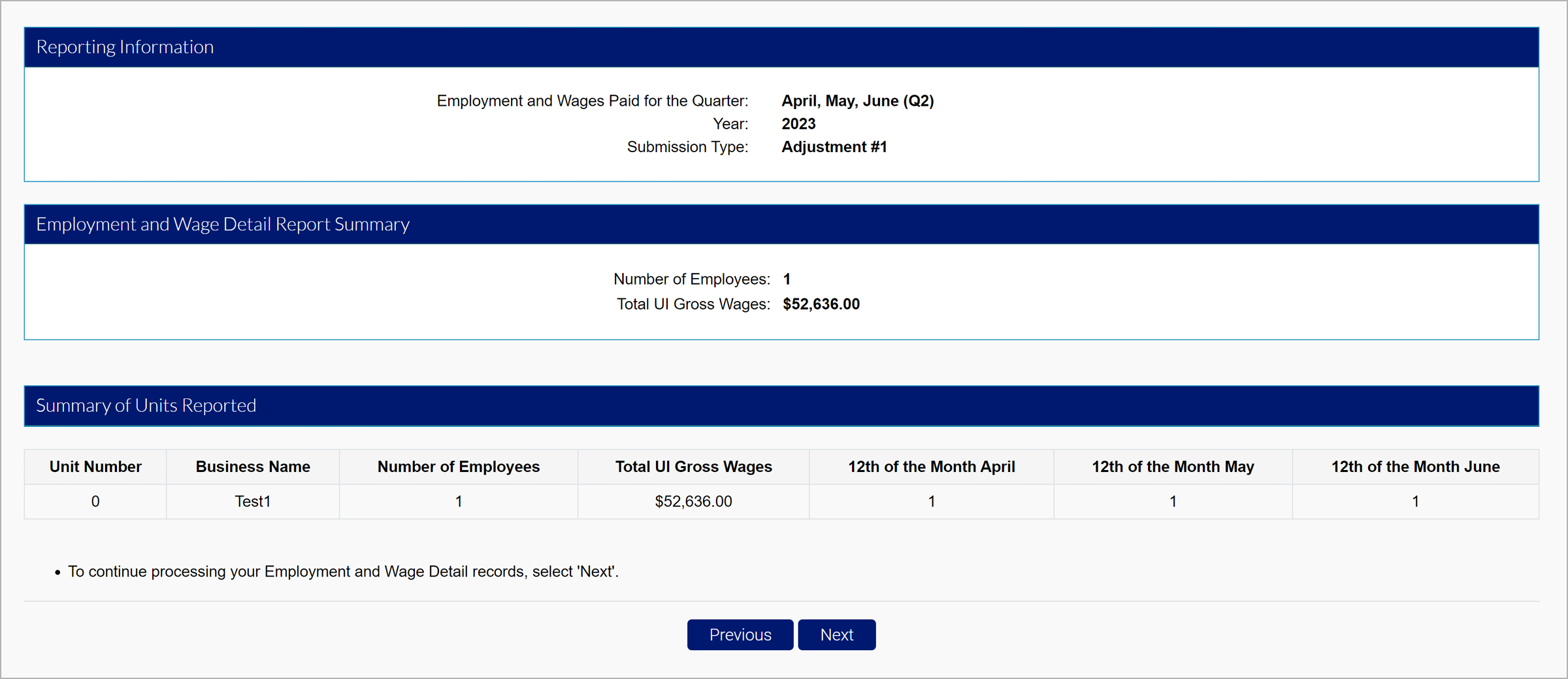

Review the summary and click “Next”.

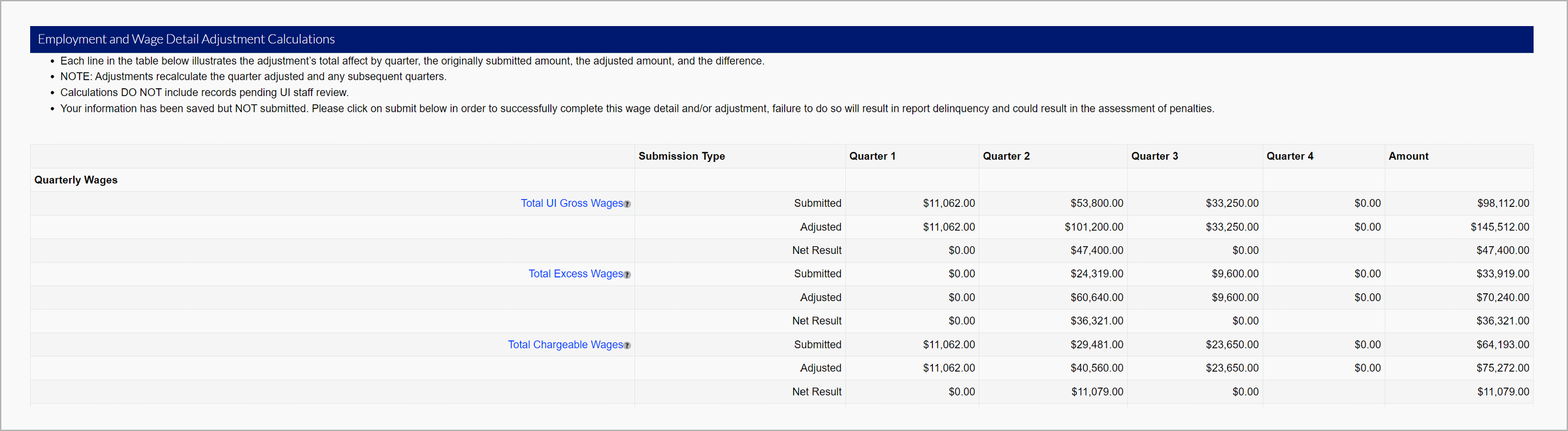

The breakdown will now include the original submission, the adjustment, and the net. You may owe additional premiums, or be provided a refund depending on the adjustment.

The Total UI Gross Wages tooltip states: The sum of all wages paid to the employee for services performed in the quarter being reported.

Wages are payments in cash, goods, or any other medium, whether paid directly or indirectly, to compensate the employee for services performed. Such compensation includes but is not limited to salaries, commissions and bonuses, cash value of housing, meals and lodging, etc.

See the Wage and Hour Laws page on CDLE’s website for a complete definition of wages and payments that are considered to be exempt.

The Total Excess Wages tooltip states: The sum of all wages paid to each employee in excess of the taxable wage base for the year.

The Total Chargeable Wages tooltip states: UI taxable wages are the portion of Total wages paid to an employee over a calendar year which are subject to UI Premiums. This amount never exceeds the wage base for the calendar year.

The Premium Contributions tooltip states: The total amount of premiums due to CDLE for the quarter being reported.

The Employment Support Fund Surcharge tooltip states: The surcharge assessed and appropriated to the Employment Support Fund created pursuant to CESA 8-77-109(1)(b). Payments made to this fund are not included in the calculation of your annual experience rate in accordance with FUTA 26 U.S.C. sec. 3301.

The Benefit Recovery Fund Surcharge tooltip states: The surcharge assessed and appropriated to the Benefit Recovery Fund created pursuant to CESA 8-73-116(2). Payments made to this fund are not included in the calculation of your annual experience rate in accordance with FUTA 26 U.S.C. sec. 3301.

The Employment And Training Technology Fund Surcharge tooltip states: The surcharge assessed and appropriated to the Employment & Training Technology Fund created pursuant to CESA 8-77-109(2)(a.9)(II)(A). Payments made to this fund are not included in the calculation of your annual experience rate in accordance with FUTA 26 U.S.C. sec. 3301.

The Delinquent Premium Payment tooltip states: The penalty assessed when a premium balance remains on an employer account as of June 30 of any year. This penalty amount is equal to either the total premiums overdue or 1 percent (0.010) of chargeable wages from the previous calendar year, whichever is less. The penalty owed is assessed in four (4) quarterly installments in the upcoming calendar year.

The Late Wage Report Penalty tooltip states: The penalty assessed and payable by the employer when quarterly wage reports are not filed on or before the due date as defined by Regulations Concerning Employment Security 6.1.2. This penalty amount is $10 per occurrence for employers newly subject as defined by CESA 8-76-102.5(4) and 8-79-104(1)(a(II)(A), and $50 per occurrence per CESA 8-79-104(1)(a)(II)(A). Employers who are expected to file reports for periods that precede the date of registration will not receive penalty charges if the reports are received on or before 30 days after account activation.

The Interest tooltip states: The amount we charge if a premium payment is not received by the due date as defined by Regulations Concerning Employment Security 6.1.2. The rate of interest is 1.5 percent (0.015) per month, applied to all interest bearing amounts due. Interest is assessed on the 15th of each month.

The Quarterly Amount Due to CDLE tooltip states: Total amount due to CDLE for the quarter including UI Premiums, Penalties, and Interest.

Select the certification checkbox and click “Submit”.

You will be brought to the confirmation page.

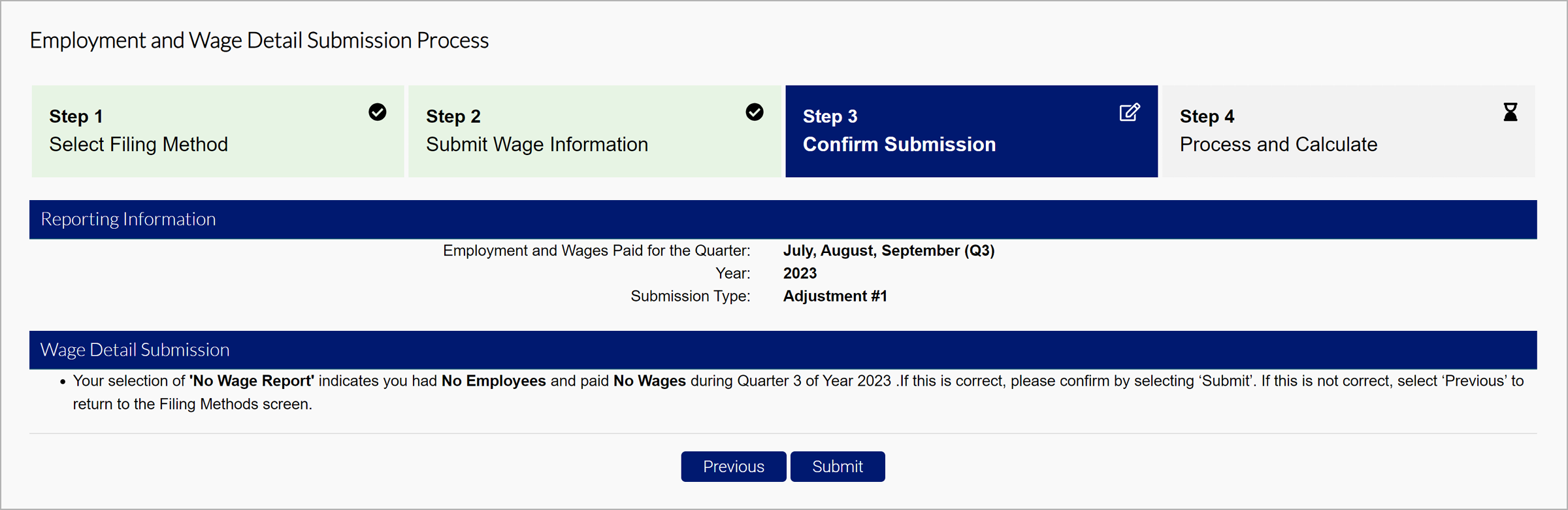

No Employment

Quarters can be adjusted to reflect no employees and no wages. Click “Submit”.

You will be brought to the confirmation page.