Shutdown Resources

STOP & READ

If you are a federal employee who has lost your job (not furloughed from a shutdown), please return to the main Resources for Federal Workers page for more information on filing your claim. The information below is specifically for Federal employees furloughed due to a government shutdown.

Resources for Federal Workers Furloughed by the Government Shutdown

The federal government shutdown will not impact normal unemployment insurance processes. The Division of Unemployment Insurance will remain open. We will continue to pay unemployment benefits. If you have a claim on file, please continue to request payment every week. If you need to reopen your claim, please check out the FAQs below for instructions.

You may be eligible for regular unemployment benefits if you have been furloughed as a direct result of the federal shutdown. You will be responsible for repaying any unemployment benefits you received when you get back pay for the time you were furloughed. The Federal Government Employee Fair Treatment Act of 2019 (GEFTA) requires retroactive pay and leave accrual for federal employees affected by a government shutdown. The law does not cover employees of federal contractors. More information regarding federal contractors and the shutdown can be found in our FAQs below.

To file your claim as a furloughed federal employee:

Please file your claim online with MyUI+

You must complete Identity Verification using ID.me when you file your claim through MyUI+. To complete ID.me verification for CDLE, you must go to MyUI+ and either link your existing ID.me account or create a new one. Once you have created a new account or linked your existing account, you will complete ID Verification to file your claim. Information on the ID.me verification process, required documentation, and instructions for linking an existing account can be found on our Verify Your Identity with ID.me page.

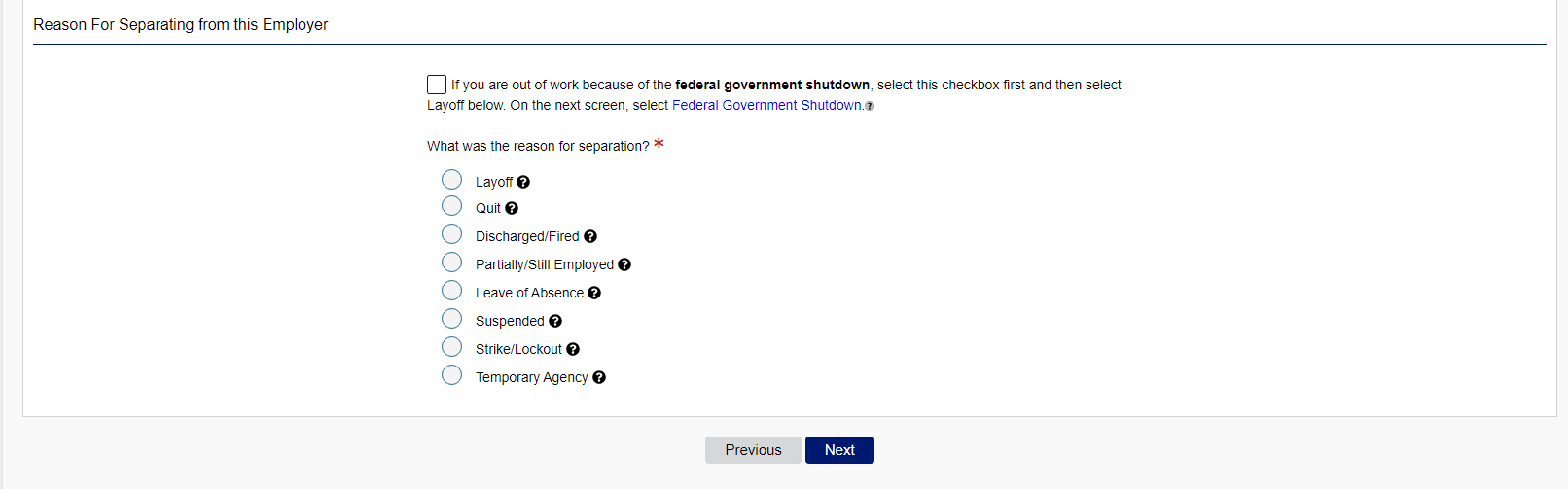

When filing your claim, select the checkbox indicating you are out of work due to the federal government shutdown, and then select layoff as the reason for separating from your employer:

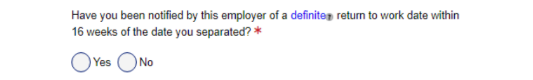

If you expect to return to work as a furloughed federal worker, you should indicate that you plan to return to work. This tells the division that you are job-attached. If you are job attached, you will not be required to search for work. For your anticipated return-to-work date, we recommend selecting a date 16 weeks from the date you file your claim.

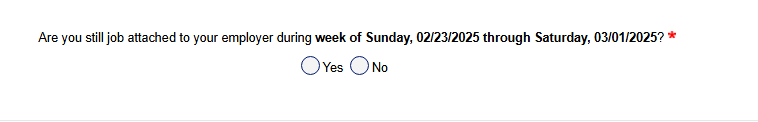

You should also answer YES that you are job attached when that option is presented.

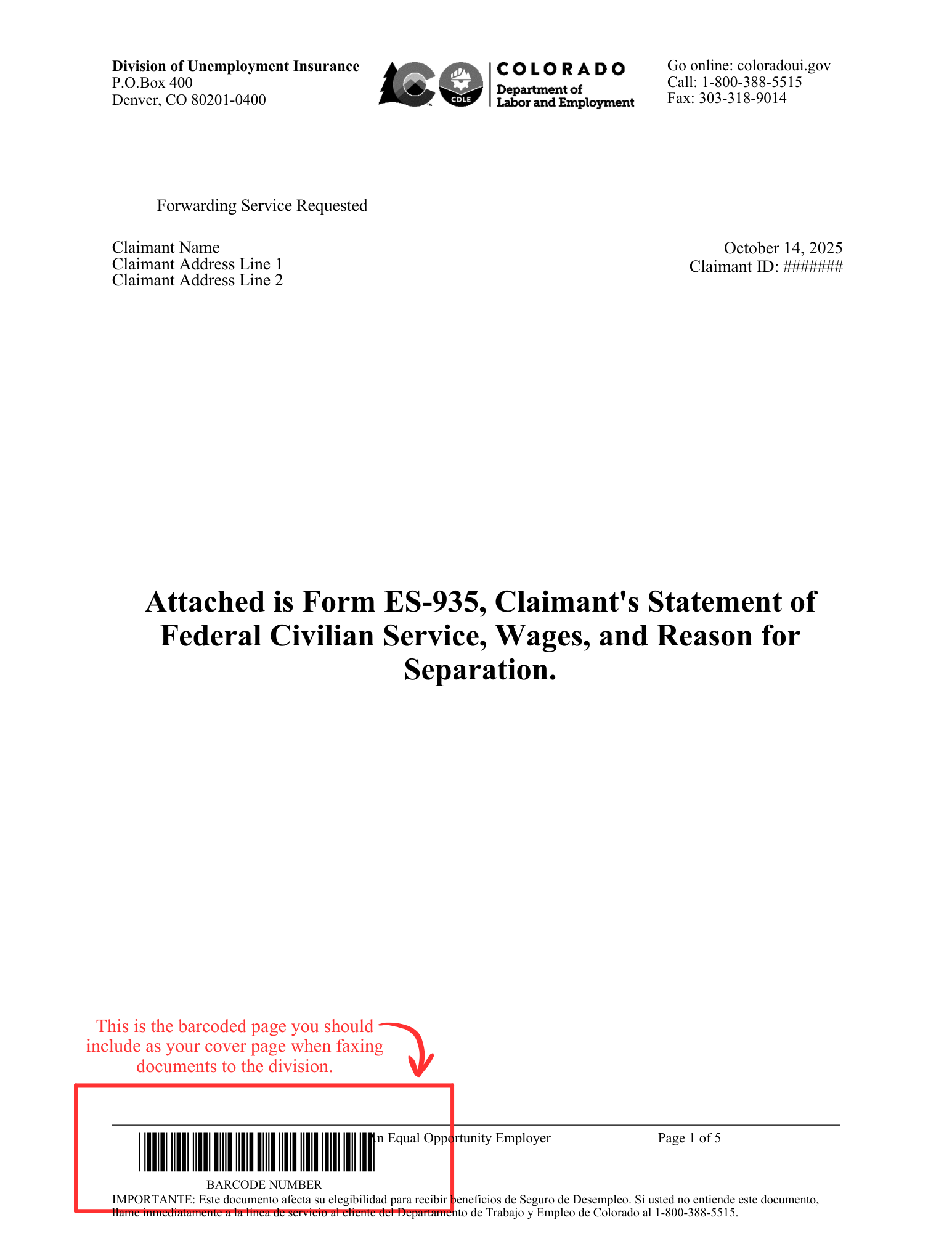

You will need to fill out the ES-935 Response to Wage and Separation form that we send you. You may also submit a Notification of Personnel Action (SF50), a Notice to Federal Employee About Unemployment Insurance (SF8), and a check stub when requested.

You must return the ES-935 form as soon as possible to prevent delay on your claim. For instructions on how to upload documentation, you can visit our File a Claim page. If you fax us documentation, include the barcoded page we sent you as the cover page. You can also upload documentation to the division by using the upload documents form on our website. Make sure to select that you are a claimant, select “Federal Claims Information Requested by the Division”, and include your claimant ID.

If you fax us documentation, include the barcoded page we sent you as the cover page.

When you file your claim, you must choose a payment type. CDLE provides benefit payments by directly depositing your payment into a verified bank account or by signing up for a U.S. Bank ReliaCard®. For more information on payment types and details regarding bank verification, please visit our Payment Page.

After you file your claim, here is what to expect:

- When you file your claim as a federal worker, you will most likely receive a $0 wage determination. This is normal for a furloughed federal employee. We have to verify your wages with your employer. A $0 wage determination doesn’t mean that you may not receive benefits; it may mean that you don’t have wage info available yet. You should upload any proof you have of your wages. We have to contact both you and your employer to verify your wages. It may take up to 2 weeks to verify your wage information with your employer.

- Request payment every week. You need to request payment once you have wages on your claim. It can take up to two weeks for the division to obtain your full wage information from your employer. Until this happens, you are likely to have a $0 wage determination and will be unable to request payment. Once your wage information has been added, request payment by logging in to MyUI+ and completing your weekly payment requests, which appear on your claim status tracker. When you request payment, you should certify your availability and ability to work, and report your work search activities, any completed work, income received, and any new job separations. Failure to request payment weekly will result in your claim being moved to an inactive status.

- When you return to work and receive back pay, you will need to repay your unemployment benefits. You will be contacted by our overpayments team to help guide you through the process of repaying benefits.

- Any UI benefits you receive will be reported on your 1099-G tax form for the year, even after you have paid back those benefits. Your 1099-G will reflect the gross amount of your UI Benefits. The UI Division cannot issue a corrected 1099-G tax form to reflect a benefits payback. Please consult your tax professional.

Government Shutdown FAQs

- How do federal workers file for unemployment benefits?

The quickest way to file a claim is online through MyUI+. Furloughed federal workers can also file their claim by phone by calling 303-318-9000 (Denver Metro) or 1-800-388-5515 (Toll-Free) starting on their first day of furlough. Please be aware that our Customer Service Center call line often has wait times for a representative to speak with you. DO NOT WAIT to file your claim. It can take four to six weeks to process your claim. If you think you will need benefits, we recommend filing as soon as possible after your last day of work. The sooner you file, the sooner you will receive benefits if you are approved.

- What documentation do furloughed federal workers need?

Fill out the ES-935 Response to Wage and Separation form that we send you. You may also submit a Notification of Personnel Action (SF50), a Notice to Federal Employee About Unemployment Insurance (SF8), and a check stub when requested. For information on how to upload documents to the division, please visit our File a Claim page. Instructions are located at the bottom of that page. You can also upload documentation to the division by using the upload documents form on our website. Make sure to select that you are a claimant, select “Federal Claims Information Requested by the Division”, and include your claimant ID.

- What is the difference between a furlough due to a government shutdown and a federal layoff?

- Furloughed workers are workers who still have a job but are not allowed to work because the government has shut down. Furloughed government workers will go back to work when the shutdown ends. Furloughed federal employees will receive back pay once the shutdown ends. This backpay is guaranteed by the Government Employee Fair Treatment Act of 2019.

- Laid-off employees are not expected to return to work. Their employment has been terminated. If you accepted a separation agreement from your employer, you may or may not be eligible for unemployment benefits. For information on unemployment benefits as a laid-off federal employee, please visit our “Resources for Federal Workers” page.

- What should I put as my reason for separation if I have been furloughed because of the federal shutdown?

If you are currently not working due to the federal government shutdown and for no other reason, when prompted to enter a reason for separation, please select the checkbox that says “If you are out of work because of the federal government shutdown, select this checkbox first and then select layoff below.”

- What happens when federal workers receive back pay after the shutdown ends?

Federal law requires the government to pay you back pay for the time you were furloughed. As a federal worker, you are responsible for paying back any unemployment benefits received during the shutdown. If you have already requested unemployment benefits and receive payment from your government job, you must provide detailed information about your compensation, including dates and gross amounts. Our overpayment team will contact you regarding benefit payback.

- The claim application mentions a job search requirement. Do federal employees have to search for a job while furloughed?

Federal employees who are furloughed due to the government shutdown are considered job-attached and do not need to conduct a job search during the furlough. Select YES to any question asking if you have “been notified of a date that you will return to work” or any question asking if you are job-attached. When you add a date, we suggest selecting a date 16 weeks from the date you file your claim as your return-to-work date. If you are a federal employee who has been laid off, you are not considered job-attached.

- Are employees who are working without pay eligible for unemployment?

At this time, federal workers who are working full-time (32 hours or more) are not eligible for benefits. This includes workers who may be required to go to work without pay. Even if you are not paid during the shutdown, you are still considered employed full-time if you are working 32 hours or more per week. By law, the federal government is obligated to pay employees back pay when the shutdown ends and they return to work.

- I received a wage determination of $0. What does that mean?

Federal employees who apply for unemployment will likely receive a wage determination of $0 in MyUI+. This is because the Federal government does not report wages to us regularly, so we will not have a record of your wages in the system. Make sure you have responded to any fact-finding requests sent by the division and submitted any relevant pay information. A $0 wage determination doesn’t mean that you may not receive benefits; it may mean that you don’t have wage info available yet. You should upload any proof you have of your wages when you file your claim. It may take up to 2 weeks to verify your wage information with your employer.

- I submitted my claim. What do I do now?

After submitting your claim, you should:

- Respond to any fact-finding requests or requests for documentation quickly.

- If required, register for work on ConnectingColorado.gov within seven days of filing (this applies to laid-off workers, not to job-attached workers).

- Request payment weekly in MyUI+. You should request payment even if you have not received a decision on your claim.

- Check your MyUI+ account frequently for new information and correspondence. Fact-finding requests have a short turnaround time and strict deadlines.

- How do UI Benefits Impact My Taxes?

Federal employees will receive back pay for the time they were furloughed. This will result in an overpayment of the UI benefits you received. Your 1099-G shows the full amount we paid you in unemployment benefits, even though you are repaying those benefits. Any unemployment benefits paid during the calendar year must be reported as income. Check the instructions on your tax form to see how to report the unemployment benefit income and the amount repaid.

The Division provides you with monthly records of your repayments. You can reference the monthly statements to determine the total amount you repaid during the year. Credit for repayment(s) can only be claimed in the year in which repayment(s) were paid back to us. Remember that overpayments are included in 1099-G amounts, but offsets are not. We cannot provide advice; check with the IRS if you are not sure what to do.

- What do I do if I already filed a claim during the last federal shutdown?

If you are a furloughed federal worker who filed for unemployment during the 2025 Government Shutdown and need to file again for benefits, you will need to reopen your claim.

To reopen your claim:

- Log in to your MyUI+ account

- On the left side menu, click reopen claim.

- You will be asked to release your information to the division. Please click accept and click next.

- The system will ask you to review your contact, payment, and general information on the next screens.

- If your information has changed, click Edit on the appropriate screen to update it.

- If everything is accurate, you can click next.

- Please note: It is vital that your information is as up to date as possible to prevent delay or denial of your claim.

- Answer the question about whether or not you have worked.

- You will then be asked to give information about your employer. You will need to add your most recent employer and any other employer that you have worked for since you last reported information to CDLE.. Please follow the on-screen instructions depending on your situation.

- You will be asked, “Have you been notified by this employer of a definite return to work date within 16 weeks of the date you separated?”

- You should answer YES to this question if you have a reasonable expectation that you will return to work at a later date.

- The division recognizes that the government shutdown is unpredictable. We suggest you select 4/4/2026 as your return-to-work date. (We know this is not the actual date.)

- Make sure you select the checkbox that states you are unemployed due to the government shutdown.

- Once you have completed the employment information, click next.

- You will then answer some questions about your eligibility.

- Once you have completed these steps, click Submit to reopen your claim.